How can I check my TDS amount

Tax Deducted at Source or TDS is a way of collecting income tax from the individuals and the entities under the Income Tax Act, 1961. The TDS is supposed to deposited to the Income Tax Department by the TDS deductor after deducting TDS. TDS is usually managed by the Central Board of Direct Taxes.

What is TDS Return?

TDS Return is a quarterly statement that is submitted to the Income Tax Department by the tax deductor.

Particulars contained in TDS Return?

A TDS Return contains the following details:

- TDS Deductor’s Permanent Account Number, TAN Number

- TDS Deductee’s PAN

- Details of the TDS paid to the Government

- Details related to TDS Challan and other minor details

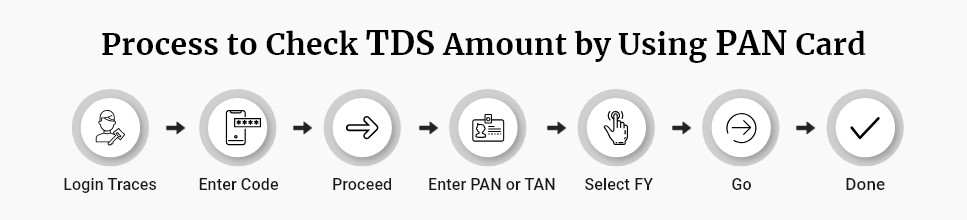

How to check TDS amount by using PAN Card?

In order to check your TDS amount by using PAN Card, you can follow the steps mentioned-below: -

- Visit TRACES official website

- Enter the verification code

- Click on ‘Proceed’

- Enter the PAN and TAN

- Select the financial year as well as the quarter and the type of return, which you wish to view

- Click on ‘Go’

- The details will be displayed on your screen

How to Check TDS amount by using Form 26AS?

In order to check the TDS amount using Form 26AS, you need to follow the steps mentioned-below: -

- Visit Income Tax Department’s official e-filing website

- Register yourself

- If you are already registered user, login using the credentials

- Go to ‘My Account’s

- Click on ‘View Form 26AS’

- Select ‘Year’ and ‘HTML’

- Download the file