What is ITR-V in Income Tax?

ITR-V stands for Income Tax Return – Verification which is a single page document that is a comprehensive summary of the tax return you file. The Income Tax Department sends the ITR-V which helps in validating the legitimacy of the IT Return filed by you. After e-filing your ITR, you can download the ITR-V from the Income Tax Department’s official e-filing portal. With the steps mentioned-below you can download your ITR-V: -

- Go to the Income Tax India website for e-filing, incometaxindiaefiling.gov.in and log in using your credentials.

- Select ‘View Returns/Forms’ option to view e-filed ITRs.

- Click on the acknowledgement number to download your Income Tax Return-Verification. There is an option to e-verify your ITR as well.

- To verify your IT Return online, select the option ‘Click here to view your returns pending for verification’.

- Select ITR-V/ Acknowledgement to start the download.

- After the download is complete, enter the password to view the document

- Take a print-out of the document in BLACK ink, sign it in BLUE ink and send it to the Centralised Processing Centre (CPC) of the Income Tax Department in Bengaluru within 120 days of e-filing the Income Tax Return.

Things to remember, while sending ITR-V to CPC Bangalore

Now that you have downloaded the Income Tax Return – Verification, here are some of the guidelines that you need to keep in mind while sending ITR-V to CPC Bangalore: –

- ITR-V should always be printed in BLACK ink.

- Only A4 size sheets should be used to print the ITR acknowledgement.

- Do not type or write anything on the back of the page on which you print the ITR-V.

- Do not attach any other document with it.

- Photocopy of signatures will not be accepted.

- Use only Ink-Jet or laser printer to print the ITR acknowledgement. Avoid printing the ITR-V on a Dot Matrix printer.

- The bar code and the numbers below the bar code should be clearly visible.

- Ensure that the print-out of the ITR-V is clear and not faded from anywhere or the Income Tax Department will not accept it.

How to check the status of your ITR-V online?

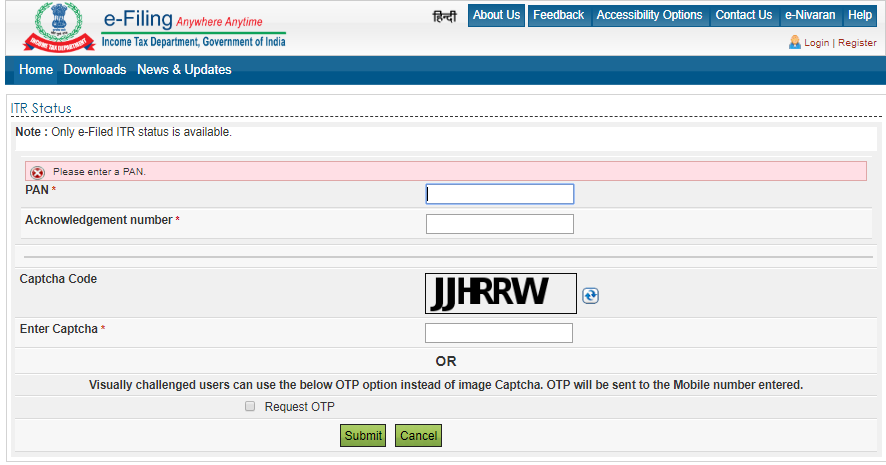

- Login to the e-filing website of the Income Tax Department and go to the ITR-V status page. { No Need to login the same page }

- Enter your PAN or acknowledgement number, assessment year and the captcha code. Now PAN Number and Acknowledgement Number is required for the same services .

- Click on ‘Submit’ to track the status of your ITR-V.