What is CPIN Number in GST?

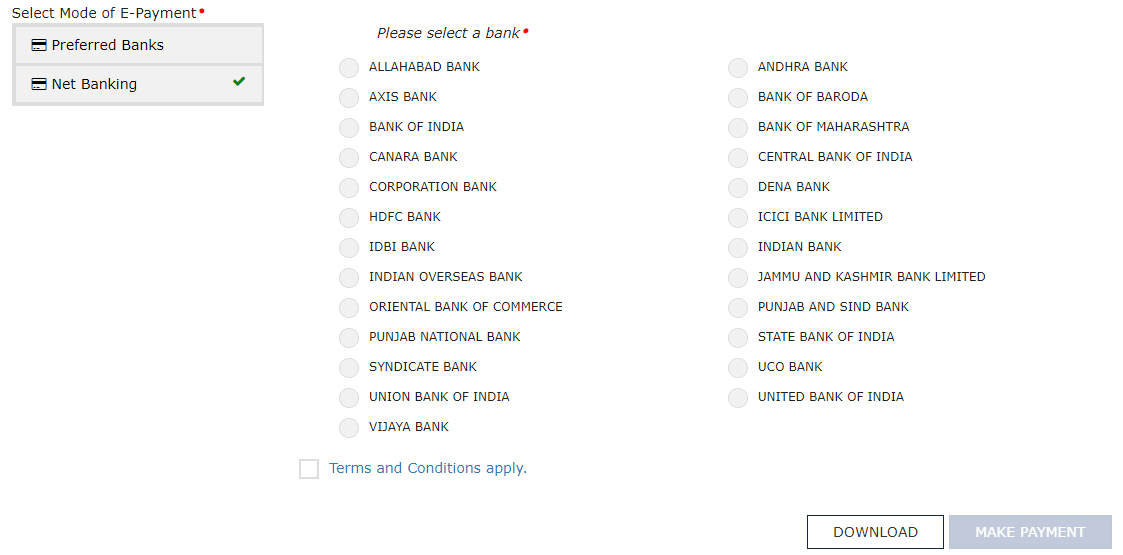

CPIN or Common Portal Identification Number, which is issued at the time while generating GST tax challan online. GST tax challan is prepared online and such GST tax challan can be saved temporarily without instructing for generation of final GST challan.

How many digits does CPIN have?

CPIN is a 14-digit unique number that is used to identify the challan and is generated by GSTN after submission of GST Challan.

What is the validity of a GST Challan?

A GST challan is valid for 15 days and gets cancelled automatically after the validity period. The taxpayer can either pay GST with such a challan bearing CPIN within validity period of its generation or he can request for a fresh GST challan online after providing necessary data for GST generation.