Income Tax Return Verification and its Procedure

The process of filing for Income Tax Returns is becoming easier and quicker through e-filing procedure with many taxpayers opting for it.

ITR-V is referred to the Income Tax Return Verification Form which is a single page document. A taxpayer receives ITR-V during filing of Income Tax Return online. ITR-V Form is filled and then sent to Income Tax Department who will verify the authenticity of the application.

ITR-V can also be defined as an acceptance slip generated after filing for Income Tax Return online. As per the Income Tax Act of 1961, for claiming Income Tax Returns, ITR-V must be signed and sent to the Department of Income Tax, Central Processing Centre, Bangalore via ordinary post or speed post. When the ITR-V form gets generated then the taxpayer should download the form and open it. The password required for opening Form ITR-V is a combination of the taxpayer’s Permanent Account Number and his / her Date of Birth.

Prepare Early for next ITR filing

- Least complicated ITR e-filing in the industry

- E-file your ITR in a few simple steps

- Expert Assistance over Chat and Email

- Click to go through the procedure for e-filing here

Electronic Verification Code for Verifying E-Returns

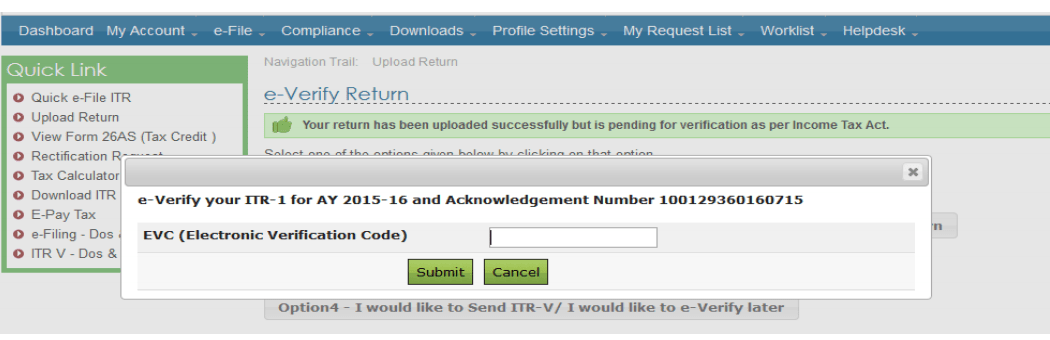

The Central Board of Direct Taxes in India recently announced that every taxpayer filing for Income Tax Return online will no longer be required to send the ITR-V Form to CPC Bangalore if the taxpayer has Aadhar Card. The taxpayer’s Aadhar Card can now be used for the verification procedure. As an alternative of manual verification, a new form of verification known as Electronic Verification Code has been launched for verifying the e-returns.

- The taxpayer must mention his / her Aadhar Card number on the Income Tax Returns Form.

- After mentioning the Aadhar Card number, the taxpayer will receive an OTP number on their registered mobile number.

- Finally, the taxpayer must enter the OTP for verification.

The procedure to follow while filling ITR-V Form via CPC, Bangalore

- The ITR-V should be printed clearly using dark blank ink and contain the original signature of the applicant, signed in blue coloured ink.

- The signature should not be marked on the bar code of the Form.

- The bar code and the numbers below it should be clearly visible.

- Do not staple Form ITR-V or fold it.

- Form ITR-V should be enclosed in an A-4 sized, white coloured envelope.

- The envelope containing the ITR-V Form must be mailed to Income Tax Department CPC Post Box No.1, Electronic City Post Office, Bangalore-560100, Karnataka, via speed post or ordinary post within 120 days from the date of post.

- The ITR-V Form should not be posted by courier.

- There will be no requirement for any supporting documents except for the signed ITR-V.

- Upon receiving the form, CPC Bangalore will dispatch an email, acknowledging that the form has been received.

- Finally, the acknowledgment e-mail from CPC must be forwarded to the email ID mentioned in the ITR.

If a taxpayer does not submit the ITR-V within 120 days, then the e-filing will be considered as invalid and the taxpayer will have to file a revised return, fill a new ITR-V then submit it within 120 days.

Frequently Asked Questions

The ITR-V or Income Tax Return–Verification Form, on the other hand, is supposed to be furnished to state that the details in the form filed by the taxpayer are verified.

Along with ITR-1 Form the following supporting documents must be submitted:

- A copy of PAN Card of the applicant.

- For salaried individuals, Form 16 is required.

- Form 16A is required for non-salaried individuals.

- Bank statement or bank passbook.

- Form 26AS.

- Proof of investments along with relevant receipts.

If a taxpayer has filed for Income Tax Returns online, he / she can easily download the ITR-V Form from the official Income Tax Department website.

- Visit the official Income Tax Department website.

- Login with the registered credentials

- Go to the Account section and choose the assessment period

- Download the ITR-V Form, and get it printed on an A4 sized paper in black coloured ink only.

Tax Guidelines

Tax Guidelines