Check My Income Tax Refund Status Online

You can check your income tax refund status online simply by providing your PAN along with the relevant assessment year.

The official income tax e-filing portal no longer displays the option to check your tax refund status from the online tabs.

View your tax refund status directly here—just sign up and click the button.

According to the Central Board of Direct Taxes (CBDT), your ITR refund will be credited by your refund banker (the State Bank of India) and transferred directly to your Savings Bank account within 10 days after your Assessing Officer forwards the refund.

Simple way to check Tax Refund online

E-file Your Income Tax Return for the Upcoming Filing Season

E-filing at unmatched affordability with All India ITR. Choose to either upload your Form 16 and self-file your ITR, or opt for our popular Expert Assisted service.

I want to e-file my Income Tax Return

Get a CA to File Your Tax Return Online

If you have multiple income sources or need detailed income projections, our Expert Assisted Plan is the best choice. File your ITR hassle-free and save time and money—plans start at just Rs.499/-

Status of Your Tax Refund

Sorry, there was a technical issue. Please try again after some time.

Income Tax E-filing

E-file your tax returns online

All India ITR Services are designed to make tax filing simple and convenient. With years of experience, we are the government's official e-return intermediary for your ITRs.

Consult Tax Expert

Our dedicated in-house tax experts are ready to advise you on any tax situation.

Probable Status That a Taxpayer May Come Across

There are 11 tax refund statuses that an individual may encounter based on the progress of their filed Income Tax Return. Below are the probable statuses:

| Probable Status | Implied Meaning | Applicable Step for the Taxpayer |

|---|---|---|

|

1.

No e-filing for this assessment year |

You have not filed your ITR or filed it manually. |

|

|

2.

Not Determined |

The tax department has not yet ascertained the refundable amount. |

|

|

3.

Refund Paid |

Your refund has been transferred. If not received, contact your bank or post office. |

|

|

4.

No Demand No Refund |

The tax deducted is accurate, meaning no refund is due. Review your ITR. |

|

|

5.

ITR Proceeds and refund determined, sent out to Refund Banker |

Your refund is processed—please wait for further details. |

|

|

6.

Refund Unpaid |

The IT department failed to deliver your refund. Verify your account number and address in your ITR. |

|

|

7.

Contact Jurisdictional Assessing Officer |

The department needs clarification on your return details. |

|

|

8.

Demand Determined |

Your demand has been determined as the IT department’s calculation shows you owe additional tax. |

|

|

9.

Rectification Proceeds, refund determined, sent out to refund banker |

Your rectified ITR request has been accepted and processed. |

|

|

10.

Rectification proceeded on, demand determined |

Your rectified ITR is accepted but additional tax is due, payable within 30 days of notice. |

|

|

11.

Rectification Proceeded on, No Demand No Refund |

Your rectification is accepted with neither demand nor refund. |

|

Frequently Asked Questions

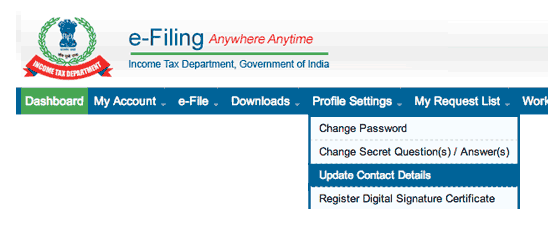

Once submitted, the new details will be updated with the Income Tax Department.

After submission, the updated details will be forwarded to the Income Tax Department.

Once submitted, your updated details will be reflected in your profile and sent to CPC for ITR update.

Register on the e-filing platform and pre-validate your bank account with your PAN.

Ensure your ITR form is error-free and that your Form 16/TDS aligns with your Form 26AS.

E-verify your online tax statement to receive an ITR-V acknowledgement.

Confirm that your ITR is not under scrutiny and that no pending rectification notices exist.

Refunds may be sent via:

a. RTGS or NECS: Transfers require a 10-digit bank account number with the correct IFSC or MICR codes and matching details.

b. Paper cheque: An account payee cheque can be dispatched to your registered address on demand.

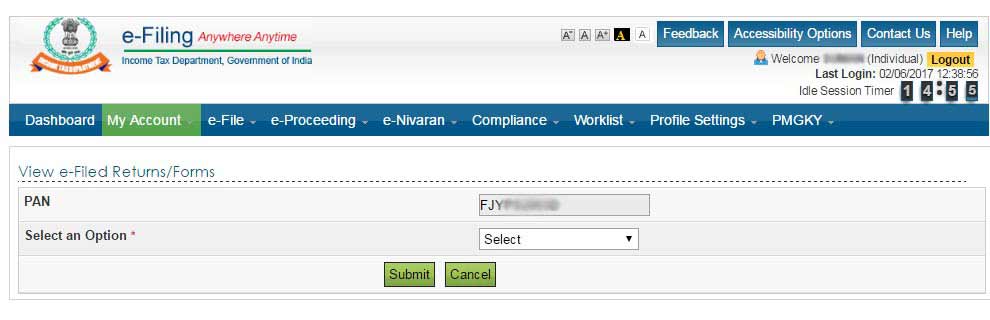

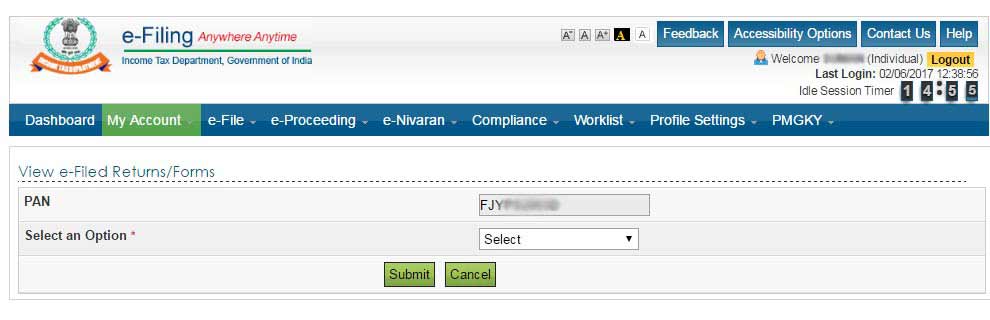

After entering your PAN and assessment year, you will see a grid with the following details:

- Mode of Payment.

- Reference Number (for internal use by CPC).

- IT Refund Status.

- Date of Refund, if applicable.

Related Articles

How to check Income.

The official website of All India ITR allows taxpayers to check income tax refund status online from the comfort...

Read More

ITR-V and Tracking

Income tax return verification or ITR-V is an acknowledgment issued by the IT department upon filing the...

Read More

Income Tax Refund

Income Tax refund is issued by the IT department after a taxpayer files income tax return through physical or online...

Read More

TDS Refund: Procedure

TDS is deducted by the employer/payer from the employee’s/payee’s income as per tax regulations...

Read More