Income Tax Refund and IT Form 30

Income Tax refund is issued by the IT department after a taxpayer files income tax return through physical or online mode. This refund is issued only the taxpayer found to have paid taxes more then they owe. Getting a refund is not necessarily a good news as it indicated that your employer has deducted more taxes from your salary. Thus, you must need a better tax planning strategy to save taxes beforehand. Claiming tax refund can save a lot of your income and tax-saving instruments like mutual funds, post office time deposit (POTD) certificates, bank FDs or term deposits, NSC certificates, tuition fees of your children, stocks and equity investments, home loan EMIs. Before making any such investments, you should read the scheme documents carefully.

Income Tax Refund

Income Tax refund is the difference between the tax levied and tax paid amount which a taxpayer receives after filing income tax return. As per Sections 237 to 245 of the Income Tax Act, 1961, a refund is issued only after a taxpayer paid the excess amount of tax than the actual tax amount.

Who can get an Income Tax refund?

In following cases, an individual or business entity can get a tax refund

- If you have paid advance taxes on the basis of self-assessment and have paid more amount than actual tax liability.

- If excess TDS has been deducted from your salary or bank deposits or security interest or debenture interest.

- If the regular tax liability gets reduced due to any error during the regular assessment process.

- If you have paid taxes in abroad for the same income you have taxed in India, you can claim a refund. This is mentioned under the rules of DTAA.

- If you have forgotten to claim tax benefits or deductions against any tax saving investment.

- If the tax paid amount is in negative figure even after considering paid tax and deductions claimed.

Get the detail process to e-verify ITR-V Get Details

How to claim Income Tax Refund in India?

Refund can be claimed during income tax filing and you need to file income tax by the due date to claim any refund. The deadline for filing income tax is 31st July of every year.

Taxes page Index

Calculate your tax liability with applying all the deduction and compare the amount with the amount paid as actual tax return. If the actually paid tax is bigger than your calculated tax liability then, that difference will be the refund amount you can claim.

Once you complete the ITR filing with Income Tax Department, they will assess your tax return. If they find that you have paid extra tax, then they will issue a refund for you. The refund is made through bank cheque which they send to your given postal address. If you have provided your primary bank account details then they will directly transfer the amount to your account.

How to claim Income Tax refund?

Declare all your investment in Form 16 while filing income tax return with IT department to claim a refund. You can mention investments such as LIC premiums, NSCs, equity fund investments, Mutual fund investments, Bank FDs, Rent generated from let out property or tuition fees.

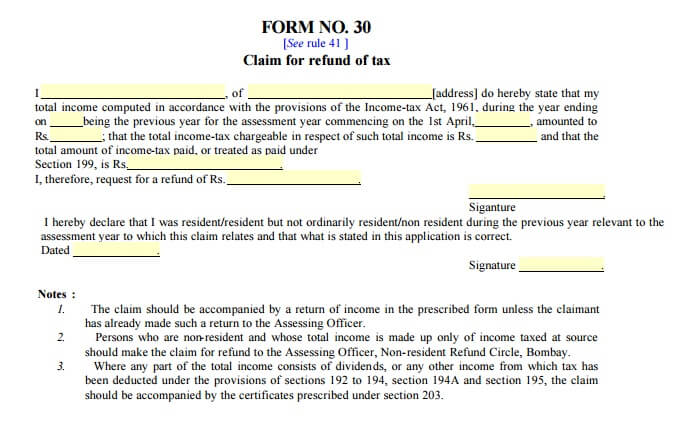

If you forget to declare your investments during ITR filing then you have to fill out Form 30. This has been provisioned under Section 139 of Income Tax Act. Form 30 is a process to request IT department to look into your cases and process your refund. this request needs to be submitted before the end of the Financial year.

A sample Form 30:

How To Keep A Track On Income Tax Refund Process?

You can keep a track on the refund status by accessing the official income tax website. Refund status can be tracked after 10 days from the claim submission and once the process gets completed by the officer, you will be notified by a message.

You need to access the NSDL-TIN website or official IT website to track your refund status. In there, click on “Status of Tax Refunds” and enter your PAN number, Assessment year to check refund status progress.

-

Track refund status in the case of Direct Transfer

If you have provided your primary bank account details while claiming income tax refund then IT Department will credit the refund directly into your account. The transfer will be done through ECS/ RTGS / NECS process which requires your account number and MICR code.

-

Track refund status in the case of Refund by cheque

If IT department issues your refund through a cheque then they will provide you a reference number. The reference number will be the speed post reference number and you can use this to track your cheque’s delivery status.

Interest Applicable If Income Tax Refund Get Delayed

If you have not received your refund within due time, then you will receive an interest at a rate of 0.5% on the refund amount for every month that the refund is delayed. The interest calculation will start from 1st April of the assessment year. However, if the delay happened due to any fault caused by you then you will not receive any interest on that.

Setting-Off Outstanding Income Tax Liabilities Against Refunds

As per Section 245, you can request tax authorities to set of your tax liabilities against the refund amount. You need to communicate with IT department in writing and it depends on them if they accept it.

People Also Searched For

In the News

-

Now, file your tax returns with All India ITR mobile app

Gadgets Now: Technology firms are gearing up to meet tax compliance deadlines with great fervour. All India ITR, an online tax compliance firm launched its e-filing app that works on both Android and iOS.

14th June 2017

Gadgets Now

Tax

Tax

Income Tax

Income Tax

Sales Tax

Sales Tax

TDS

TDS

GST

GST

Service Tax

Service Tax

VAT

VAT

Tax Calculator

Tax Calculator