Which ITR is to be filed by Whom

While paying income tax returns taxpayers often find it hard to decide which income tax return (ITR) form they need to file as there is a good number of forms. Selecting a form depends on the income a taxpayers earns. If a taxpayers holds assets in a country other than India or if he earns income from a country other than India, then these factors too also play a vital role in deciding the type of income tax return (ITR) form to be used.

Different Types of ITR Forms

There are nine types of ITR form be filed but for the individuals only six types of forms are applicable as per the Central Board of Direct Taxes. Rest of the forms are for the use of companies and forms.

The forms for the individuals are as follows

- ITR-1

- ITR-2

- ITR-2A

- ITR-3

- ITR-4

- ITR-4S

The forms for the companies and firms as follows

- ITR-5

- ITR-6

- ITR-7

Taxes page Index

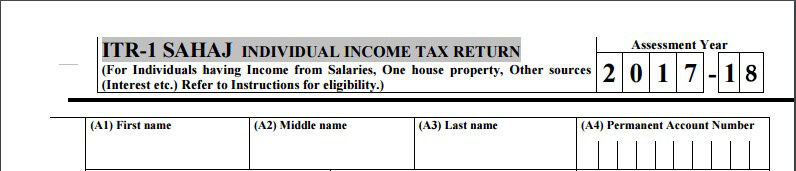

Here we describe ITR Forms-ITR-1

ITR-1 is popularly called as Sahaj form. The form is meant for an individual taxpayer. The form is not applicable for other kinds of assesses liable to pay tax.

Who Can Use ITR-1 Form or Sahaj

- Individuals who earn income through salary or pension

- Those who earn income from a single housing property

- Individuals not earning income from any other business or individuals who have not earned income from the sale of any assets i.e. capital gains.

- Individuals with no assets or property in a country other than India

- Individuals not earning income in a country other than India.

- Individuals earning an income from agriculture which is below Rs 5,000.

- Those earning income from various investments that include Fixed Deposits, Investments, Shares, etc.

- Those who have not received income from a windfall that include winning a lottery or horse racing.

- Those who wish to club the income of their spouse or underage child with their own income, as long as it is in accordance with the above mentioned rules.

Who Can’t Use ITR-1 Form or Sahaj

- Individuals with a total income exceeding Rs 50 lakhs.

- Individuals owning foreign assets are ineligible

- Individuals earning an agricultural income of more than Rs. 5,000 are also ineligible.

- Individuals with taxable capital gains

- Individuals earning an income from business or profession

- If you have income from more than one house property you also can’t file this form.

Structure of Form 26AS in India and its significance for Taxpayers Get Details

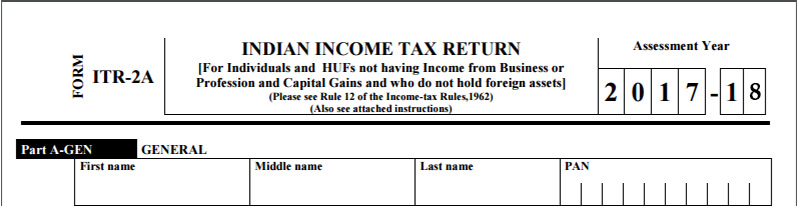

ITR-2A

ITR-2A form is meant for individuals and Hindu Undivided Family (HUF). Here we give a details of assesses who can or can’t file ITR-2A.

Who Can Use ITR-2A Form

- The ITR-2A form is applicable for individuals who earn income through salary and don’t have a single house property and don’t have any capital gains.

- This form is also applicable for those who earn income from salary and have more than one house property but don’t have any capital gains.

- The form can also be used by those who have earned income from winning lottery or income from Race Horses.

- NRIs can file ITR-2A, if applicable. But here is a word of caution. Individuals who have a foreign asset or foreign income are not eligible to file this form.

Who Can’t Use ITR-2A Form

- The ITR-2A can’t be used by those with income from Capital Gains.

- The ITR-2A can’t be used by those with income from business or profession.

- The form can also be not used by individuals with assets outside India or owning an account outside India.

- Individuals with sources of income outside India.

ITR-2

The ITR-2 Form is applicable for the individuals who have earned income through the sale of assets or property. The form is also applicable to individuals who have income sources outside India. Here is a detailed list of who can use this form and who can’t.

Note: ITR-2A form has been discontinued and merged with ITR-2 form

Who Can Use ITR-2 Form

- Individuals earning Income through salary or Pension are eligible.

- Individuals earning income from house or property (also include income from more than one house or property).

- Individuals earning income through capital gains (Both Short Term and Long Term)

- Individual earning income through other sources that include winning from Lottery, bets on Race Horses or through legal ways of gambling.

- Individuals with income as a partner in the firm. Previously there was a separate ITR form 3 for this purpose which has now been discontinued and merged with ITR 2.

- Individuals with foreign Assets/Foreign Income

- Individuals with agricultural Income more than Rs. 5000

Who Can’t File ITR-2 Form

- The form should not be used by an individual or a Hindu Undivided Family whose total income consist of income earned from Business or profession.

- Individuals eligible for filing ITR-1 form.

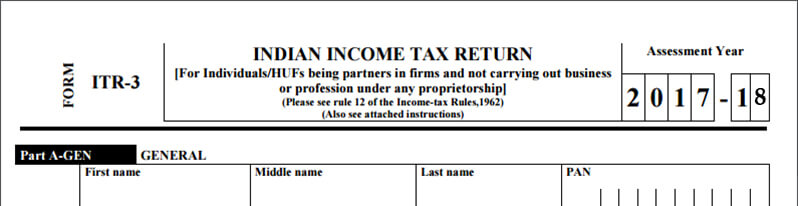

ITR-3

The ITR 3 Form was applicable to individual and Hindu Undivided Family (HUF) who earned income from proprietary business or are carrying on profession. Those earning income from business or profession were eligible to file this form. Those earning presumptive business Income where Turnover/Gross Receipts exceeds Rs. 2 crore were also eligible.

Note: This form has now been discontinued and merged with ITR-2.

ITR-4

The ITR-4 form is applicable to individuals who earn income through a business or through a profession. All kinds of businesses, undertakings or professions with no limit on the income earned are eligible to file this form. Apart from the income earned from business, income earned from windfalls, speculation, salaries, lotteries and housing properties can also be clubbed together with income from business. Professionals including shopkeepers, doctors, designers, agents, retailers and contractors among others are eligible to file their income tax returns through ITR-4 form.

The Structure and Components of Form 16 in India Get Details

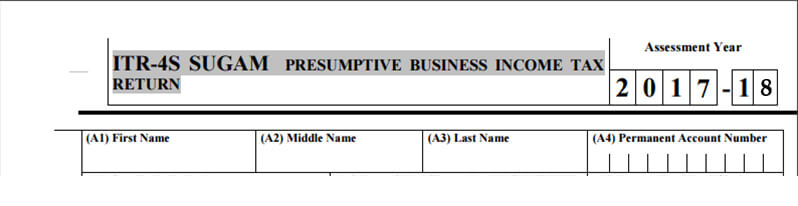

ITR-4S

The ITR-4S form was used by any individual or Hindu Undivided Family (HUF) for filing their tax returns.

Note: This form has now been discontinued FY 2016-17 (AY 2017-18) and merged with ITR-4.

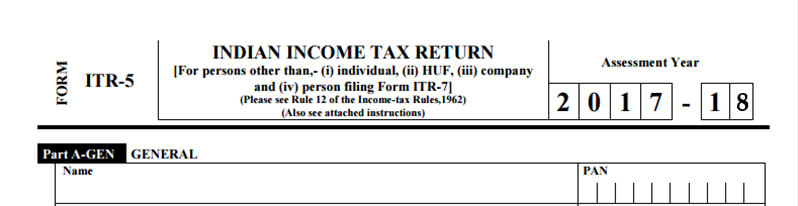

ITR-5

The ITR-5 form is used by certain entities to file income tax returns. These entities are as follows

- Firms

- Limited Liability Partnerships (LLPs)

- Body of Individuals (BOIs)

- Association of Persons (AOPs)

- Co-operative Societies

- Artificial Judicial Persons

- Local Authorities

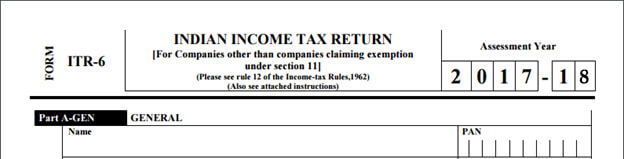

ITR-6

ITR-6 form is applicable to companies except those companies or organisations that claim tax exemption as per Section 11. The companies or organisations claiming exemptions under Section 11 are organisations wherein the income accrued from the property is used for the cause of religion or charity. The ITR-6 can be filed online only.

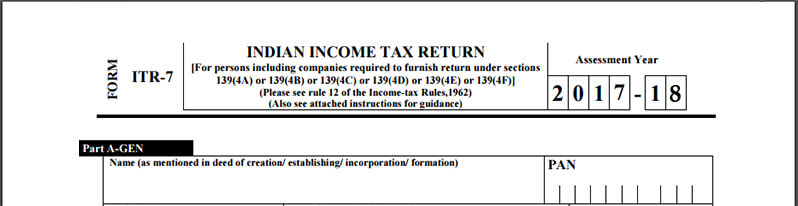

ITR-7

The ITR-7 form is applicable for the individuals or the companies that fall under the Section 139(4A) or section 139 (4B) or section 139 (4C) or section 139 4(D).

Section 139(4A) - Under this section, persons who get income from any property that is held for the charity or religion are required to file returns.

Section 139(4B) – If a political party has income above the non-taxable limit then that particular political party is required to file return under this section.

Section 139(4C) - This section is applicable for filing returns by the following entities

- Any institution or association mentioned under Section 10(23A)

- Any association involved with scientific research

- Any institution mentioned in Section 10(23B)

- Any news agency

- Any fund, medical institution or educational institution

Section 139(4D) – This section is about mandatory filing of income tax return by colleges and universities. As per this, an institution mentioned in section 35(1) (ii) or (iii) is required to file their income tax.

People Also Searched For

In the News

-

All India ITR offered free Income Tax filing assistance for Indian Armed Forced

F Samachar: All India ITR, an accredited solutions provider of tax return solutions, launched a new initiative to provide tax return services to members of the Indian Armed Forces. This announcement comes as a huge relief to thousands of personnel whose service conditions do not permit them the luxury of time to self file their mandatory tax returns. Moreover, professional CAs have been engaged to handle their queries at the same toll-free number that is available to paid subscribers.

18th July 2017

F Samachar

Tax

Tax

Income Tax

Income Tax

Sales Tax

Sales Tax

TDS

TDS

GST

GST

Service Tax

Service Tax

VAT

VAT

Tax Calculator

Tax Calculator