How to Make Tax Payments and TDS deductions

Why do I need Challan 280?

- Challan 280 is must for paying income tax. It is basically used for paying different types of taxes like Advance Tax, Self- Assessment Tax, Tax on regular assessment, Surtax, Tax on Distributed Profit and Tax on Distributed Income.

- Payment of income tax can be made through the online method as well as offline method, however, in both the methods a taxpayer should use Challan No/ITNS 280 to make the payment of the income tax.

How to use Challan 280 for Online Tax Payment?

A taxpayer can make his/her tax payment using Challan 280 online.

You can use following steps for online tax payment using Challan 280:

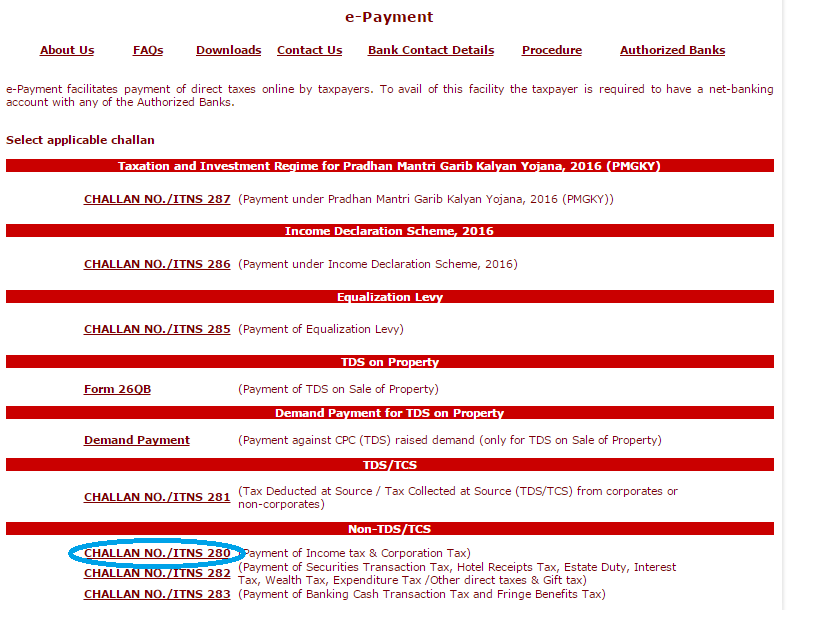

Step1: Go to e-Payment options of Income Tax Department website.

Step2: Select Challan No./ITNS 280 for the payment of Income and Corporation tax.

Step3: Fill the required credentials in the field.

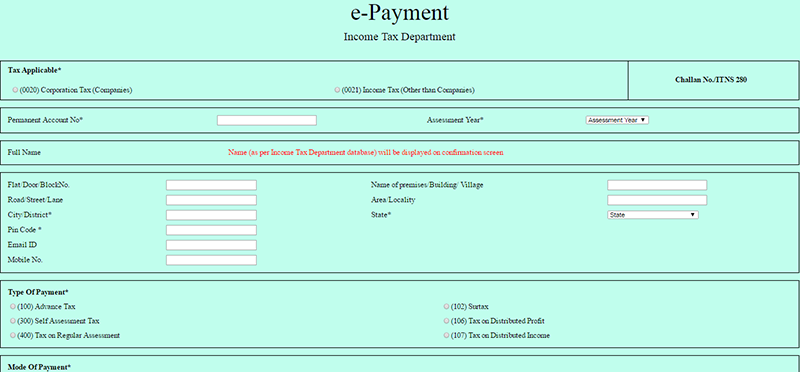

A taxpayer should keep in mind the following instructions while furnishing Challan No./ITNS 280 –

1) Tax applicable – There are two options in the Challan 280 for the taxpayer, namely, (0020) Corporation tax and (0021) Income tax. If the tax is levied on a company then the taxpayer should choose (0020) Corporation tax; and if the tax levied is income tax other than companies such as LLP, Partnership firms, individuals, etc. then the tax payer must choose (0021) Income tax.

2) PAN number – It is important to furnish the PAN number in Challan 280 carefully, to avoid tax deposit under someone else’s name. The name of the taxpayer will be traced automatically from the name on the PAN number. However, you can see the name of the taxpayer on the confirmation screen after clicking Submit.

3) Assessment year – The assessment is normally the next year of the financial year. Choose the assessment year carefully as the option to pay for previous years depends on the year you choose.

4) Type of payment – The tax payer should choose the payment mode depending on the financial year he/she chooses. For example – if you are paying the tax for the same financial year based on the estimated income then you should choose Advance tax, whereas if you are paying tax after the end of the financial year you must choose Self-Assessment year.

5) Bank Name – The tax payer should select the name of the bank from where he/she intends to make the online payment via net banking.

6) Amount of tax – The amount of tax will be mentioned on the bank website and not on the Challan 280.

Step4: Once you furnish the credentials click the Proceed button given at the bottom left corner of the page.

Step5: Step 4 will lead to the confirmation page, where the taxpayer’s details will be displayed.

Step6: If the details on the confirmation page are correct then click Submit to the Bank button. Or else, edit button and this will lead you to the first page to edit the details.

Step7: Login to your bank account as after submitting to the bank the banker will automatically ask you to login to your bank account.

Step8: Choose the tax amount you would like to pay. For instance – education cess and surcharge levied on the same, interest and penalty (if any).

Step9: Press Calculate Tax button. It will show the total amount of tax to be paid including education cess and surcharges, interest and penalty.

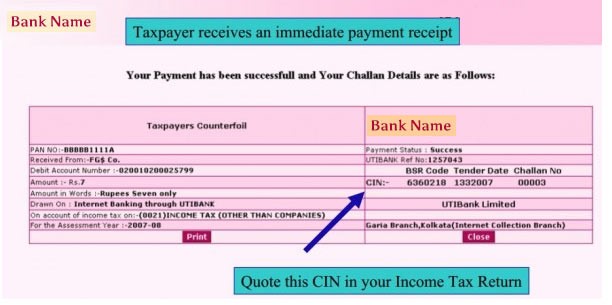

Step10: Make the payment online. You will see a challan counterfoil on your screen with Challan Identification Number (CIN) instantly. You can print or save this payment challan.

Note: The taxpayer should keep a copy of the payment challan as the CIN will be quoted in the income tax return.

How to Pay Tax offline, using Challan 280?

The taxpayer can also make his/her tax payment using offline mode. For this method, the taxpayer needs to download Challan 280 from the official IT website. Fill the credentials, such as your PAN number, assessment year, registered address, mobile number, e-mail id, etc.

Physically go to the bank along with the filled form and the amount of tax you want to pay and make the payment.

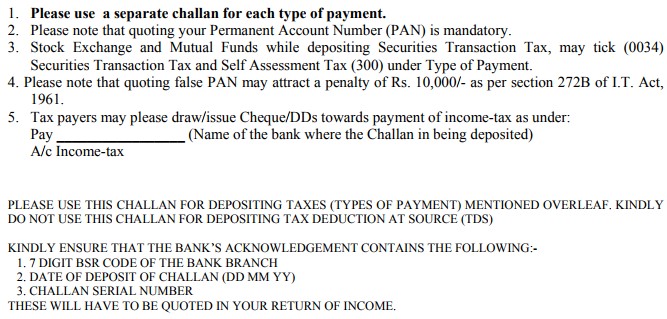

Important instructions you should keep in mind while filling the form manually

- For each type of payment use separate challan

- Quoting your PAN is mandatory. Avoid quoting wrong PAN number as it is liable for penalty of Rs. 10,000/- under section 272B of Income Tax Act, 1961.

- You should choose either 0020 or 0021 tax under Tax Applicable.

- You should enter the 1st Assessment year of the block period followed by the last Assessment year of the period. For instance – if the block period is 1/04/2011 to 5/03/2016 then in the space indicated for Assessment year, you should enter as 2012-2017.

- For payment of income tax draw/ issue cheque/DDs as –

- Pay____________ (Name of the bank where challan is deposited)

- A/c income tax.

How to fill Challan 281?

Following are the details that you need to fill in Challan 281:

-

Tax Applicable: This is the first column of the challan, it has two options:

- 0020: This option is applicable in case of income tax for companies, that is, if the deductee is a company such as ABC ltd. then code 0020 should be selected. Whether an entity is a company or not can be checked by the PAN no. of the entity, in case of a company the fourth letter of the PAN No. will be “C”.

- 0021: This option is applicable in case of income tax for other than companies, that is, if the deductee is not a company, they may be an individual, HUF, partnership firm, etc.

- Assessment year: The assessment is normally the next year of the financial year. Choose the assessment year carefully as the option to pay for previous years depends on the year you choose.

- TAN No., Name and address: Enter the TAN no. and name of your company. TAN no. or Tax Deduction and Collection Account Number is a 10-digit alpha numeric number issued to the people who are subject to deduction or collection of tax on the payments made/received by them under Income Tax Act, 1961.

- Type of payment: It depends on the TDS payment category.

- If the tax is paid by the tax payer on monthly basis on his own, then you can tick mark on the TDS/TCS payable by tax payer option.

- If the tax is paid by the tax payer based on the demand made by Income Tax Department, then you can tick mark on the TDS/TCS regular assessment (Raised by IT Department) option.

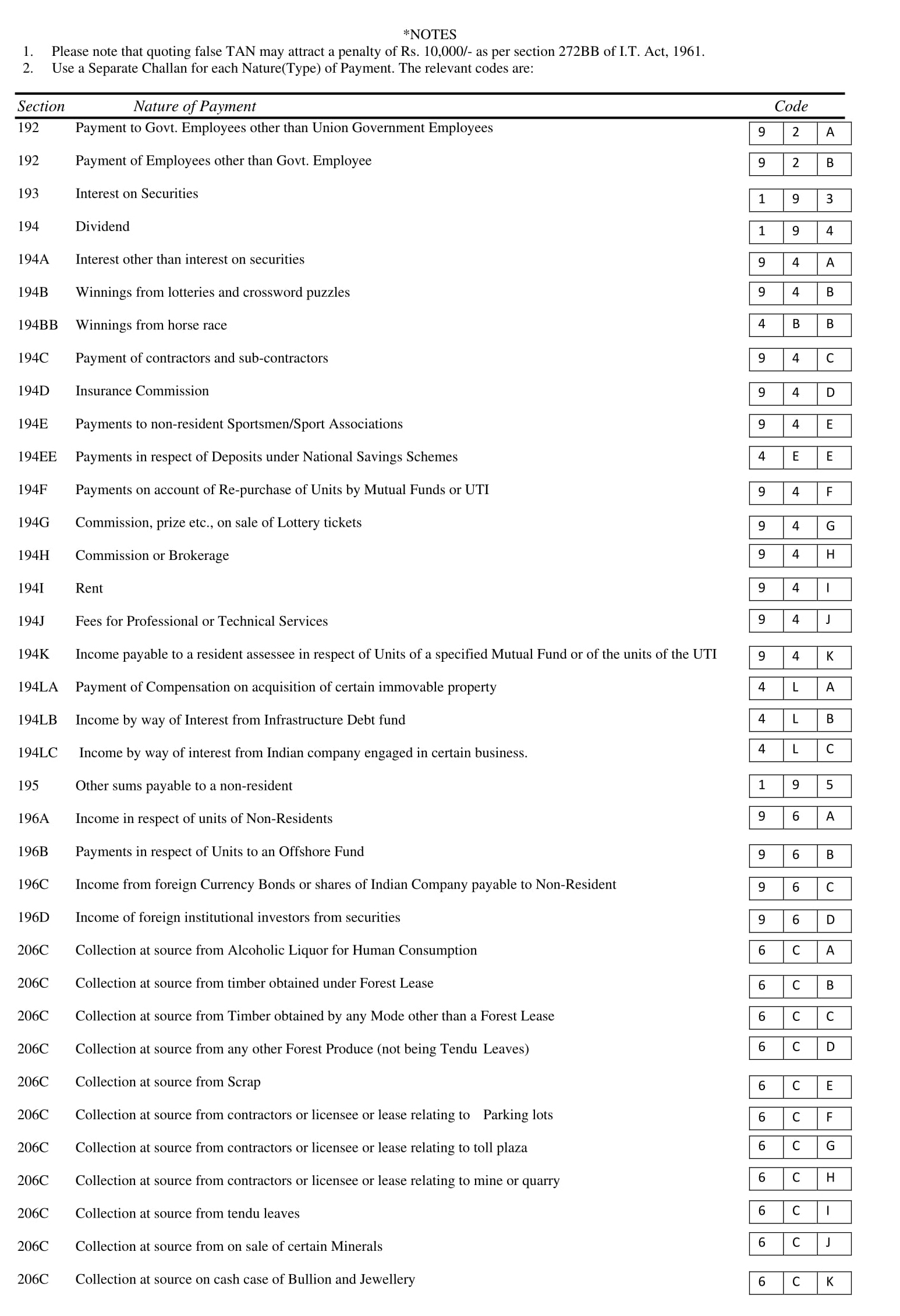

- Nature of Payment: you have to fill the code as per the section under which TDS/TCS is deducted.

- You must ensure that, you have used separate challans for payment under different sections.

- Details of Payment: Enter the details of payment like, income tax, surcharge, etc. in figures as well in words. You must also enter the details related to cheque, DD, etc. along with the date and bank branch.

How to use Challan 281 online?

- Login to official Income Tax website.

- Click on Challan No./ ITNS 281.

- Fill the required details such as TAN no., address, mode of payment, bank name, etc. and click on Proceed.

- Confirmation screen will be displayed, check the details you have entered.

- Click on the Submit to bank option.

- This will be redirected to the net-banking site of the bank.

- Enter the user id and password provided by bank for net-banking purpose.

- Enter the payment details, that is, the amount to be paid.

- Click on the submit option.

- On successful payment, a challan counterfoil will be displayed that will have CIN No., payment details, and bank name through which e-payment has been made.

How to submit challan 281 offline?

- Download the excel format of challan 281 or TDS challan from the official IT Department’s website.

- Fill in the necessary details

- Submit the challan to the bank along with the amount to be paid

- After submitting the challan, bank will issue a counterfoil/ receipt back stamped as a proof of submission.

What is Income Tax Challan 282?

A tax payment form used to pay Securities Transaction tax, Hotel receipts tax, Estate duty, Interest tax (on bank FDs, Savings accounts etc.), wealth tax, gift tax and any other such direct tax.

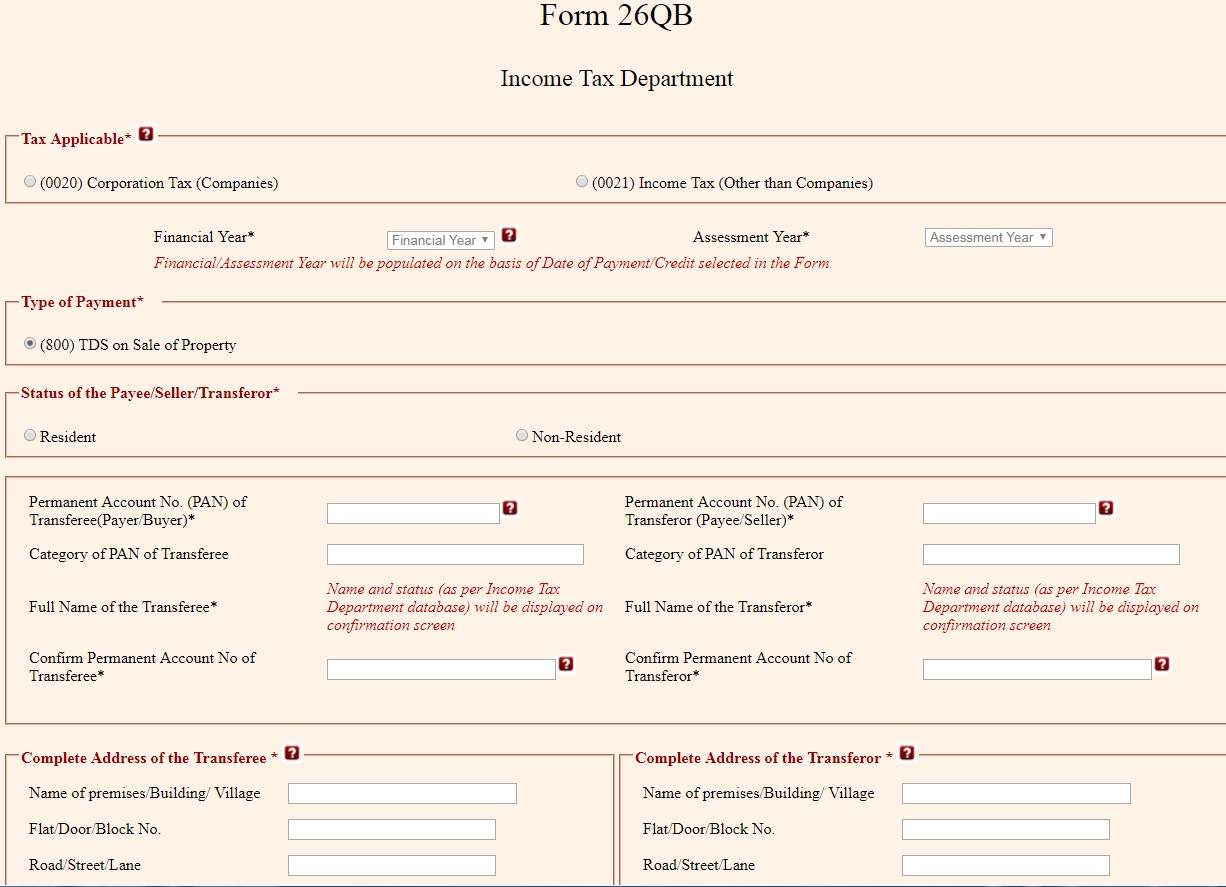

What is Form 26QB?

This is used to pay TDS on Sale of Property by the seller of the property. Such tax can be paid online at the tin nsdl website using internet banking.

You must note down the Challan Identification Number (CIN) after every tax payment because this would need to be quoted when you file your income tax return.

After 5 days have elapsed on paying this amount you can download a certificate of tax for the buyer called Form 16B from the TRACES portal.

You don’t have to be a math genius to do your taxes! You can easily hire a tax expert. We, at AllindiaITR guarantee you the best rates in the market for highly professional financial services. Our online platform is owned and operated by Corwhite Solutions Private Limited.

People Also Searched For

In the News

-

All India ITR Launched Income Tax E-Filing app

Silicon India Finance: Tax enabling firm, All India ITR has launched a unique mobile app that promises completion of e-filing of income tax returns in under 2 minutes. With help from a team of experts available just a call away, you cannot fail to meet compliance deadlines in 2017.

14th June 2017

SILICONINDIA FINANCE

Tax

Tax

Income Tax

Income Tax

Sales Tax

Sales Tax

TDS

TDS

GST

GST

Service Tax

Service Tax

VAT

VAT

Tax Calculator

Tax Calculator