Income tax is the only tax element that involves every earning individual and government collect a huge amount of revenue through this process. Firms and business entities working in India or registered in India are also liable to pay taxes. From last few years, IT department has introduced digital tax filing facility so that people can file income tax online. Income Tax Return E-filing is free through using government’s website. Nowadays, there is quite a few intermediaries can be found who offer tax E-filing facility in change of fees and work as a third party organisation.

It is the type of tax imposed on individual’s annual income by the Indian Government. Income tax rate imposed on individuals as per the income tax slab defined by the government. Tax is imposed on all kind of income including earned and unearned income.

Return of Income

Individuals or businesses pay a return a part of income as a tax every year which is defined as the return of income. This return is submitted to the income tax department and the return is made through using different forms. This forms can be collected from the IT office or from the website of IT department.

ITR Filing Due Date 2016-17

or salaried individuals, Hindu Undivided Family (HUF), Body of Individuals (BOI) and Association of Persons (AOP), the due date for filing ITR for FY 2016-17 is 31st July 2017.

Prepare Early for next ITR filing

- Easy ITR e-filing with All India ITR

- E-file your ITR in few simple steps

- Expert Assistance over Chat and Email

Start e-filing

Individuals and HUF (Below 60 years of age)

| Income Tax Slab |

Tax Rate |

| Up to INR 2,50,000 |

NIL |

| From INR 2,50,000 to INR 5,00,000 |

5% |

| From INR 5,00,000 to INR 10,00,000 |

20% |

| Above INR 10,00,000 |

30% |

|

Surcharge:

- 10% of income tax will be charged for income from INR 50 Lakhs to INR 1 Cr.

- 15% of income tax will be charged for income from above INR 1 Cr.

|

For Individuals and HUF (From 60 - 80 years of age)

| Income Tax Slab |

Tax Rate |

| Up to INR 3,00,000 |

No Tax |

| From INR 3,00,000 – INR 5,00,000 |

5% |

| From INR 5,00,000 – INR 10,00,000 |

20% |

| Above INR 10,00,000 |

30% |

|

Surcharge:

- 10% of income tax, where total income is between INR 50 lakhs and INR 1 crore.

- 15% of income tax, where total income exceeds INR 1 crore.

|

For Super Senior Citizens (above the age of 80 years)

| Income Tax Slab |

Tax Rate |

| Up to INR 5,00,000 |

No Tax |

| From INR 5,00,000 – INR 10,00,000 |

20% |

| Above INR 10,00,000 |

30% |

|

Surcharge:

- 10% of income tax will be charged for income from INR 50 Lakhs to INR 1 Cr.

- 15% of income tax will be charged for income from above INR 1 Cr.

|

Individuals and HUF (Below 60 years of age)

| Income Tax Slab |

Tax Rate |

| Up to INR 2,50,000 |

NIL |

| From INR 2,50,000 to INR 5,00,000 |

10% |

| From INR 5,00,000 to INR 10,00,000. |

20% |

| Above 10,00,000 |

30% |

| A surcharge at a rate of 12% of income tax will be charged for income from above INR 1 Cr. |

For Individuals and HUF (From 60 - 80 years of age)

| Income Tax Slab |

Tax Rate |

| Up to INR 3,00,000 |

No Tax |

| From INR 3,00,000 to INR 5,00,000 |

10% |

| INR 5,00,001 - INR 10,00, 000 |

20% |

| Above INR 10,00,000 |

30% |

| A surcharge at a rate of 12% of income tax will be charged for income from above INR 1 Cr. |

For Super Senior Citizens (above the age of 80 years)

| Income Tax Slab |

Tax Rate |

| Up to INR 5,00,000 |

No tax |

| From INR 5,00,000 to INR 10,00,000 |

20% |

| Above INR 10,00,000 |

30% |

| A surcharge at a rate of 12% of income tax will be charged for income from above INR 1 Cr. |

| Form |

Brief |

| ITR-1 |

Also known as SAHAJ form, is appropriate for salaried individual or pensioner or person earning from one house property or other sources (excluding the income from lotteries or race horses). |

| ITR-2 |

Appropriate for individuals or Hindu Undivided Families who earn from any resources except “Profits and gains of business or profession”. |

| ITR-3 |

Appropriate for individuals or Hindu Undivided Families who earn from “Profits and gains of business or profession”. |

| ITR-4S |

Also known as SUGAM form, it is appropriate for individuals and HUFs who file income tax as per the presumptive taxation scheme under Section 44AD/44AE. |

| ITR-4 |

Appropriate for individuals or HUFs earn from a proprietary business or profession. |

| ITR-5 |

Appropriate for business entities such as firm, LLP, AOP, BOI, artificial juridical person, co-operative society, and local authority.

This form must not be used by any trusts, political parties, institutions, colleges or entities who required to file ITR under Section 139(4A), 139 (4B), 139(4C) or 139(4B).

|

| ITR-6 |

Appropriate for companies that do not claim any deductions under Section 11. |

| ITR-7 |

Appropriate for all entities who furnish ITR under Section 139(4A), 139 (4B), 139(4C) or 139(4B). |

| ITR-V |

The acknowledgment form generate after filing income tax return. |

Income tax is collected against the earning made from salary income, earning from other sources, capital gains, interest from saving accounts and dividends. Earning individuals need to file income tax return for every financial year on specified due date. E-filing of income tax return has been introduced a few years back where tax filers can file income tax return through an online platform. Filing tax return proves your income and build your credit history. E-filing also require e-verification through prescribed methods and failing in furnish e-return by the deadline can draw a penalty liability on you.

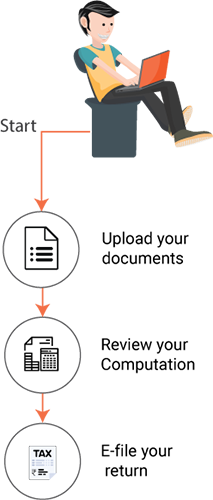

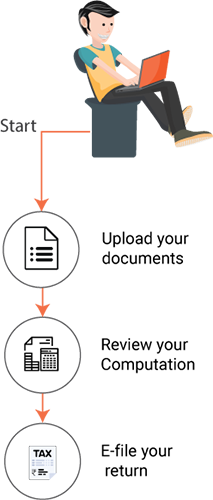

Before start E-filing tax return through any online platform, must keep these three documents ready with you

- Form 16

- Bank statements

- Copy of the previous year’s return

Now follow these steps to complete E-filing income tax return

- Go to the official E-filing website.

- Complete the registration process and get your user account.

- Check the Tax Credit Statement (Form 26AS) to see the tax deducted and deposited with the Income Tax Department.

- Now tally the amount of Tax Deducted at Source (TDS) mentioned in Form 16 with the amount mentioned in Form 26AS.

- Download the ITR form for the current financial year by clicking on the “Download” button. Or click on the “Quick E-file ITR” link to complete the process through the online platform.

- Use the Income tax calculator to calculate income tax liability for yourself.

- Fill in all the detail sin the challan form and click on “Validate” tab to confirm all information.

- Generate the “XML file” and save it to your computer. Now upload the return form and digitally sign your form using the digital signature.

- An acknowledgment form called “ITR-V” will generate after successful completion of the process. Download the form and print it out. You need to send this printed out the form to the CPC, Bangalore.

- Visit the official website of the Income Tax Department and choose appropriate option to initiate the E-filing process.

- Upon redirecting to other pages, select the right ITR form for yourself.

- In official website, you can find two utilities for the FY 2016-2017. These two utilities are Java Utility and Excel Utility.

If you choose JAVA utility

- Once downloading completes, open it and click ‘Prefill’.

- Enter your User ID, Password, DOB/DOI and choose to Prefill Address.

- Enter all the details and calculate the tax need to be submitted.

- Save the XML file and click on Submit.

If you choose Excel Utility, then

- Once downloading completes, open it and fill in the form.

- Confirm the entered information and calculate the tax need to be submitted.

- Generate XML and save it to your computer.

- Now upload the file on official E-filing website.

- Once uploaded, attached all the documents and click on “Submit”.

The following documents need to be attached with the offline form

- Copy of last Year’s ITR

- TDS Certificates

- Bank Statement

- Savings Certificates

- Interest Statement

- Balance Sheet, Profit and Loss Account Statement and other Audit Reports (if required)

The offline process is the same for all type of ITR forms.

Why Filing Income Tax Return is Necessary

In India, if any of the below-mentioned condition applicable, then filing ITR is necessary

- If gross total income per financial year falls under the income tax slab.

- All company or firm or businesses need to file ITR regardless of the profit or loss made in a financial year.

- If you want to claim a tax refund.

- If you want to carry forward a loss under the head of income needs.

- If any Indian resident holds a property or asset in abroad.

- If any Indian resident holds signing authority in a foreign account.

- If you receive income from any property held under a trust for charitable or religious purposes or a political party or a research association, news agency, educational or medical institution, trade union, a not for profit university or educational institution, a hospital, infrastructure debt fund, any authority, body or trust.

- If you are applying for any loan or visa

- If any NRI earns income through any Indian sources, then it will be taxable in India.

For few cases, online filing of Income Tax Returns is necessary

- If you are looking to claim a refund.

- In the case of earning total income exceeding INR 5, 00,000.

- ITR-3, 4,5,6,7 have to be file through online basis only.

Benefits of E-filing Income Tax Return

- Online filing of ITR makes it much easier to complete the process without facing any traffic. The last date for E-filing ITR is 31st July of every year.

- You can file ITR in advance to avoid any penalty or charges.

- It helps to create a good financial history in a much faster and easier way. Online history is much favoured by a lot of organisations.

- You get ITR-V ready in your hand which is an important proof of tax history.

Q. If a self-employed professional has earned below income tax slab for the current year and has earned above the taxable income in last two years, then do they need to file a return for the current year?

If one has filed income tax for the previous year’s then they must file it for this year to declare a low income. This is also recommended as IT department may consider your non-filing as a delayed filing or non-compliance because of your past return filing history.

Q.Is it alright to skip ITR filing if one have already paid advance taxes and have no dues or refunds?

No, one still need to file ITR as it gives a complete record of your income distribution to the government. It is a mandatory process and helps the government to track tax frauds. In case one has missed it, they will have to pay penalty for late filing or non-filing.

Q. Is an ITR useful for a citizen’s daily life?

Yes, as it is a proof of your income and you will need it while applying for a bank loan or visa. You will also need it for claiming any accidental insurance or for any judicial or Class 1 jobs or winning a tender or to register into any professional panels or to claim funding for startups.

Q. Is it possible to File Income Tax Return after the due date?

Yes, you can file a late return after the due date as prescribed under Section 139 (4). Such return must be filed before the end of Assessment Year or before the Assessment is completed, whichever is earlier.

Q. How to check the status of refund?

You can check your refund status on the official website of the Income Tax Department. Refund status can be checked after 10 days from the date of filing ITR return.

Q. How long it takes to receive income tax refund?

Refunds are generated only after IT department process your return. The maximum possible time to get a refund back can be up to 1 year if you are liable to receive any refund. If IT department finds that you are not eligible for any refund they will notify you the same. If you think their calculation is wrong, then you can communicate with them in writing. Refunds are released through cheque sent to your address or transferred to your primary bank account.

Tax

Tax

Income Tax

Income Tax

Sales Tax

Sales Tax

TDS

TDS

GST

GST

Service Tax

Service Tax

VAT

VAT

Tax Calculator

Tax Calculator