A Complete Guide to Tax in India

Brief about the income tax for beginners

Taxes are involuntary fees levied by governments on citizens and corporates to generate revenue to undertake projects in order to boost economy and quality of life. The government of India derives the authority of collecting taxes from the constitution that grants union and state government power to levy taxes. All types of taxes levied by Central and state governments should be in accordance with the law passed by the Parliament or the State Legislatures.

Types of Taxes

There are two types of taxes - direct and indirect. These taxes are differentiated on the basis of the way these are levied. Direct taxes are paid directly by the citizens. Income tax, wealth tax, corporate tax are common examples. Indirect taxes are paid indirectly in the form of value added tax, service tax, sales tax, etc.

Apart from these two conventional taxes, there are other types of taxes that are levied by the central government to achieve a particular goal. These taxes can be introduced under both categories – Direct and Indirect. Recently introduced Swachh Bharat Cess tax, Krishi Kalyan Cess tax, and infrastructure Cess tax are common examples.

Direct Tax

Taxes page Index

Direct tax, as the name suggests are taxes that are directly by the citizens. Such kinds of taxes are levied directly on an entity or an individual. These taxes are non-transferrable. Central Board of Direct Taxes (CBDT) which is a part of the Department of Revenue is one of the regulatory body for direct taxes.

Tax benefits for Income Earned by Senior Citizens in India Get Details

CBDT works in accordance with the various acts that rules various aspects of direct taxes. These acts are as follows

Income Tax Act

Income Tax Act is also referred as the IT Act of 1961 and sets the rules for the income tax in India. The income that comes from any source like a business, owning a house or property, gains received from investments and salaries comes under its purview of this act. The act also defines the tax benefit on a fixed deposit or a life insurance premium. The same act defines how much of income an individual can save through investments and what would be the income tax slabs the income tax slabs.

Wealth Tax Act

Introduced in 1957, the Wealth Tax Act regulates the taxation related to the net wealth of an individual, a company or a Hindu Unified Family (HUF). To make it simple, if your net wealth exceeds Rs. 30 lakh, then 1% of the net wealth that exceeds Rs 30 Lakh would be payable as the tax. It was abolished in the Union Budget 2016-2017 and it was replaced with a surcharge of 2% on super rich with a taxable income of more than 1 crore annually. The surcharge is also applicable to the companies with an annual revenue of Rs. 10 crores. These changes increased the amount that goes into the government coffers.

Gift Tax Act

The Gift Tax Act introduced in 1958 suggests that if an individual receives gifts - monetary or valuables - a tax would be levied on such gifts. There was a provision of 30% tax on such gifts The gifts was taken in the form of like property, jewellery, shares etc were taxable. It was abolished in 1998. As per the new rules, gifts given by family members that include brothers, sister, parents, spouse, aunts, and uncles are not taxable. The gifts received from the local authorities is also non-taxable. To put it simply, if someone, except the exempt entities, gifts you anything that exceeds a value of Rs. 50,000 then the entire amount of gift is taxable.

Expenditure Tax Act

The Expenditure Tax Act that was enacted in 1987 deals with the expenses an individual, may incur while using the services of a hotel or a restaurant. The act is applicable throughout India except the state of Jammu and Kashmir. According to this act, certain expenses are chargeable under this act if they exceed Rs. 3,000 in the case of a hotel and all expenses in the case of a restaurant.

Interest Tax Act

The Interest Tax Act that came into existence at 1974 deals with the tax that was payable on interest earned in a specific situation. As per the last amendment, the act does not apply to interest that was earned after March 2000.

Calculation of Tax Liability on Salary Get Details

Below are some examples of all the different types of direct taxes

Types of Direct Taxes in India

Income Tax

Income tax is one of the most popular and at the same time most misunderstood taxes. The tax is levied on individuals' and companies' earnings in a year. The Income Tax has a rich terminology that includes the tax slabs, taxable income, tax deducted at source (TDS), reduction of taxable income, etc. For individuals, payable income tax depends on tax bracket an individual falls in. Based on this bracket/slab income tax to be paid by the assesse is determined. The tax ranges from zero to 30% for the individuals falling in the high-income group.

There are different tax slabs for the individuals of the different group that includes general taxpayers, senior citizens (people aged between 60 to 80, and very senior citizens (people aged above 80).

Capital Gains Tax

Capital Gains tax is levied when you receive a large amount of money from an investment or from the sale of a property. The capital gain tax is generally of two types Short-term Capital Gains from investments held for less than 36 months, and Long-term Capital Gains from investments held for longer than 36 months. The tax applicable for each type of capital Gains tax is different as it is based on the income bracket you fall in. The tax applicable on the Long Tern Gains is 20%. The gains shouldn’t be necessarily in the form of money. It could also be in the form of an exchange. In that case, the value of exchange will be considered for taxation.

Securities Transaction Tax

Securities Transaction Tax is a tax levied on the value of securities transacted through an authorised stock exchange. However, it is not applied on off-market transactions or on the commodity of currency transaction. Whenever you trade on the stock market you stand a chance to make a good amount of money. This income is taxable that falls under the Securities Transaction Tax. The tax is applied by adding it to the price of the share. To put it simply, every time you buy or sell a share you pay the tax. All the securities traded on the Indian stock exchange comes attached with this tax.

Perquisite Tax

Perquisites can be defined as any additional benefit received by an employee other than salary or wages. The benefits may include a house provided by the company or a vehicle provided by the company. However, the perks are not limited to big compensation like cars and houses as it could be small benefits like compensation for fuel or phone bills. The Perquisite Tax is applied by taking into account how these perks are acquired by the company or used by the employee. For example, a car provided by the company and used by an employee for official as well as personal use is taxable while the car used for official purpose only doesn’t come under the purview of tax.

Corporate Tax

Corporate Tax is the tax levied on businesses on profits earned by them during a particular period of time. The taxes are levied under the income tax act 1961. If a company registered in India has a global presence then taxes will be levied on the worldwide income of the company. This tax too has different slabs that determines how much tax a company has to pay. An example will help you understand it better. A domestic company with an annual revenue of less than Rs. 1 crore needn’t pay this tax while the company with an annual revenue of more than Rs. 1 crore is required to pay this tax.

This tax is also referred as a surcharge and it different for different revenue brackets. In the case of an international company with a revenue of less than Rs. 10 million, the taxes may go up to 41.2%.

Capital Gains Tax

It is applicable on both individuals and business entities and is directly connected to many facets such as tax slabs, tax deducted at source (TDS), taxable income, and reduction of taxable income. The tax rate depends on tax bracket the assesse falls in and the tax rate range from 30% to higher income groups. The newly introduced tax slabs for financial year 2017-18 are given below.

It is of two types

- Short term capital gains from investments held for 36 months or less

- Long term capital gains from investments held for 36 months or months

Long term capital gain is taxed at a rate of 20% and short-term capital gain is taxed according to your income tax slab. The gain does not have to be in the form of money to get taxed but it can be a kind of exchange which will be taxed as per the exchange value.

Securities Transaction Tax

This tax is levied on earnings made from stock market and trade in securities. This tax is levied on the price of the share and you need to pay tax when you sell your share. All securities have this tax attached to them on the Indian Stock Exchange.

Perquisite Tax

This tax is levied on the facilities you get from your employers such as a house or a car or fuel or phone bills. However, the tax is only levied on the personal use you make out on these facilities, not on the official uses.

Corporate Tax

This tax is levied on the revenue earned by the companies and the earnings are taxed as per the defined tax slabs. For domestic companies, earning less than INR 1 Cr need not pay any tax. For international companies with earning more than 10 million INR have to pay corporate tax at a rate of approximately 41.2%, however, tax slabs are also there.

Corporate Taxes can be further divided into four types

a) Minimum Alternative Tax

Companies keep finding ways to avoid paying taxes. With Minimum Alternative Tax (MAT), the income tax department ensures that companies should pay the minimum tax. Currently, the MAT levied by the income tax department of India is 18.5%. MAT came into effect after the introduction of Section 115JA of the Income Tax Act. Companies in infrastructure and power sectors are exempted from MAT.

Revenue generated from free trade zones, charitable activities, investments by venture capital companies are also exempted from the MAT. However, there is no exemption for foreign companies with income sources in India.

Once a company pays this tax, it can be adjusted against regular taxes payable during the subsequent five-year period subject to certain conditions.

b) Fringe Benefits Tax

It is simply called as FBT is a tax levied on fringe benefits an employer provides to its employees.

This tax covers a number of aspects that include

- Any privilege, service, facility or amenity an employer directly or indirectly offers to its employees.

- Concessional travel tickets provided by the employer for private journeys of its employees or their family members.

- The contribution made by the employer to an approved superannuation fund for the employees.

- Fringe Benefits Tax also covers specified security or sweat equity shares allotted/ transferred, directly or indirectly by an employer to its employees free of cost or at concessional rate to its employees. The detailed provisions in respect of this are included in Chapter XII-H of the I.T. Act.

- Employee Stock Option Plans (ESOPs).

FBT came into existence by the finance act 2005 with effect from 1 April 2006.

c) Dividend Distribution Tax

Any company in India which has declared, distributed or paid dividend is required to pay Dividend Distribution Tax which is 15%. The tax is levied on the dividend they pay to their investors. The DDT was brought into existence by the finance act of 1997. Only domestic companies are required to pay this tax. The companies are required to pay this tax even if they don’t need to pay any tax on their income.

D) Banking Cash Transaction Tax

Banking Cash Transaction Tax is another tax which is no longer in existence. It was operational from 2005-2009 until the then Finance Minister Pranab Mukherjee abolished it. As per this tax, every bank transaction (debit or credit) was liable to be taxed at a rate of 0.1%.

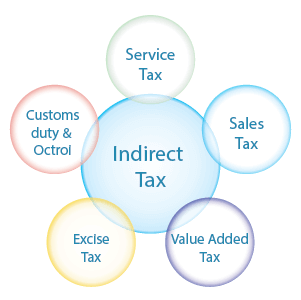

Indirect Tax

Indirect Tax is self-explanatory. These are the taxes that are applied on goods and services. It differs from the Direct Taxes as these are not collected from the individuals. These taxes are levied on products and services and are collected through intermediaries or the persons or the individuals selling the products and services. VAT (Value Added Tax), Taxes on Imported Goods, Sales Tax are some of the common types of indirect taxes. The taxes are collected by adding it to the prices of products and services and consequently, the prices shoots up.

Get the detail process of Indirect Tax in India Get Details

Types of Indirect Taxes in India

Sales Tax

The term sales tax can be easily understood. It is the tax that is charged on the sale of a product. The product could be something produced In India or imported to India. It also covers the services offered. The tax is levied on sellers of the products who collects it from the buyers by adding sales taxes to the prices. The tax can only be levied once and if a product is sold the second time, the sales tax can’t be levied on it.

Different states of India has their own sales tax acts so the percentage of tax levied is also different. Apart from the sales tax, certain states in India also levy additional charges that include turnover tax, purchase tax, works transaction tax etc. No doubt sales tax is one of the largest revenue generators for the various state government in India.

Service Tax

Service tax is the tax which levied on the services provided by a service provider in India. The tax is payable by the service provider in India who can collect it from the consumers. In the Union Budget 2015. The service tax has been increased from 12.36% to 14%. The tax is not levied on goods but on companies that provide services. The tax is collected every month or once every quarter depending on the nature of services provided. If the service provider is an individual, the tax is levied once the customers pay the bills. In case the service provider is a company the tax is levied once the invoice is generated, even if customers doesn’t pay the bill. As services of a restaurant is a combination of food, water, and the premises it is hard to determine that on what service tax is applicable. To make it clear, the service tax is levied on only 40% of the total bill.

GST - Goods and Service Tax

- Benefits of GST for the Business and Industry

- Easy compliance

- Uniformity of tax rates and structure

- Minimal cascading of taxes

- Creating healthy competition for business and industry

Value Added Tax

An indirect tax, Value Added Tax in India is introduced into Indian taxation system with effect from 1 April 2005. The tax is levied throughout the different stages of supply chain right from the manufacturers, dealers and distributors to the customers. The value added tax is levied on the discretion of the state. The VAT consists of 3 schedules and every schedule has a different VAT percentage. For Schedule 3 the VAT is 1%, for schedule 2 the VAT is 5%. The goods that don’t fall in any category is charged with a VAT of 15%.

Customs Duty & Octroi

When we need to buy something which is required to be imported from a foreign country then we have to pay a certain charge. This charge is called custom Duty. The Customs Duty is applied to all the products whether these are coming from land, sea or air. Even if you bring home a product that is bought in a foreign country a custom due will be levied on it. The aim of the Customs Duty is to make sure all goods coming to India must be taxed and paid for.

Octroi is the tax that is levied on goods when it enters a particular state. It varies from 3 to 6% depending on the product. Octroi is in existence in Gujarat, Maharashtra, and Punjab while states of Odisha and Kerala collects Entry Tax.

Excise Duty

Excise Duty is a tax levied on all the good and products produced and manufactured In India. It differs from the Customs Duty in the manner that is only levied on products produced in India. Also referred as the 'Central Value Added Tax ' or CENVAT, this tax is collected from the government from the manufacturers. This tax can also be levied on the entities that receive manufactured goods from the manufacturers and employ people to bring the products from manufacturers.

As per the Central Excise Rule, every person who produces or manufactures any 'excisable goods', or stores such goods in a warehouse is liable to pay the excise duty. This rule suggests that no excisable goods, on which any duty is payable, will be allowed to move unless excise duty is paid.

Other Taxes

Apart from the Direct and Indirect Taxes, there are also some small taxes that are in existence in India. These small cess taxes may not be the great revenue generators but help government to arrange funds for several initiatives to give a boost to infrastructure and quality of life. The funds generated through this are used for some particular purposes based on the Minister’s discretions. Some of the common other taxes are as follows.

Read More About

Examples of Other taxes

Professional Tax

Professional Tax also called employment tax is levied only by state governments in India. As per the rules of this tax individuals making an income through a profession such as a Doctor, Lawyer, Chartered Accountant, or Company Secretary Etc. are required to pay this tax. However, not all states collect the professional tax and the slabs also differ from the state to state.

Property Tax - Municipal Tax

Property Tax or Real Estate Tax is the taxes levied by local municipal bodies of every city. These taxes are collected to arrange fund to maintain the basic civic amenities in the cities concerned. All owners of residential or commercial properties are required to pay this tax.

Entertainment Tax

Entertainment Tax is one of the most common types of taxes in India. This tax is levied on feature films, television series, exhibitions, amusement, and recreational parlours. This tax is levied by taking into consideration a business entity’s gross collection from commercial shows, film festival earnings and other kinds of entertainment activities.

Stamp Duty, Registration Fees, Transfer Tax

Stamp duty, registration fees, and transfer taxes are supplementary of property tax. Most of us have paid for stamps (stamp duty), registration fees (fee charged by local registrar to legalize a property transaction), and transfer tax (tax paid to transfer the ownership of a commodity while buying a property.

Education Cess/Surcharge

Education cess was introduced to help collect the funds for the government-sponsored educational programs. This tax is independent of other taxes and is levied on all Indian citizens, corporations, and other people living in the country. Currently, the educational cess in India is 2% of an individual’s income.

Gift Tax

You might get amazed to know that tax is also levied on the tax an individual receives. If you receive a gift from another person. It will be considered to be a part of your income generated through “other sources” and hence it is liable for the tax. Gift Tax is applied when the gift amount is more than Rs. 50,000 a year.

Wealth Tax

Wealth Tax was another popular form of tax charged by the government and was decided by the net wealth of the assesse. The net wealth of an assessed can be measured by taking into account all the assets an individual owns minus the cost of acquiring them (any loan taken to acquire them). This tax was abolished in the Union Budget of 2015.

Toll Tax & Road Tax

You might have stopped at a toll plaza to pay toll tax during your journey through road. Toll tax or road tax is collected when you use an infrastructure developed by the government. Roads and bridges are common examples of this kind. The tax amount collected is used for the maintenance and better upkeep of the project.

Swachh Bharat Cess

Swachh Bharat Cess was imposed to generate funds for clean India. Introduced through the finance act 2015, the cess came into effect on 15 November 2015. According to this act, the government can levy a cess of 0.5%.on all the taxable services. This cess is levied over and above the 14% service tax that is currently being imposed. Swachh Bharat Cess is not applicable on the services that are exempted fully from the service tax or the services covered under the negative list of services. The cess collected is deposited under the Consolidate Fund of India and is used to support any government initiative related to clean India. This cess is separate from the service tax and mentioned separately in invoices.

Krishi Kalyan Cess

Are you noticing that your restaurant bill, phone bill, and other utility bills have increased a little bit? If you see the detailed bill you will notice that a Krishi Kalyan Cess (KKC) of 0.5% has been added. Krishi Kalyan Cess is collected to fund financial activities related to agriculture and farmer welfare. The tax is charged separately but listed with service tax on your invoice. As per the receipt budget, the government expects to collect Rs 216,000 crore for the financial year 2017, out of which Rs 5000 crore will be collected through the KKC.

Infrastructure Cess

Infrastructure Cess is levied on the production of vehicles in India. It is 1% for small petrol/LPG/CNG-driven motor vehicles not larger than 4 meters and engine capacity not less than 1200cc. An infrastructure cess of 2.5% will be charged on diesel driven motor vehicles with the length not more than 4 meters and engine capacity not more than 1500cc. In the case of big Sedans and SUVs a cess of 4% will be levied.

Entry Tax

Entry tax is a tax collected by certain states across India. Uttarakhand, Madhya Pradesh, Gujarat, Assam, and Delhi are some of the prominent states collecting it. Under this, all items entering these states ordered via e-commerce will be taxed. The entry tax varies from state to state and it stands between 5.5% and 10%.

People Also Searched For

In the News

-

All India ITR to offer free income tax filing assistance for Indian Armed Forces

HTDS Content Services: Tax return filing still remains a tiresome and complicated process even though the authorities have made great strides towards simplifying tax compliance. Tax consultants are still required to guide most citizens through arcane financial jargon. By launching a free tax solutions service backed up by professional CAs, Vikas Dahiya, CEO and founder of tax consulting platform, All India ITR, hopes to alleviate the troubles of at least one class of citizens whose contribution to society is immense yet largely unrepaid.

18th July 2017

HTDS Content Services

Tax

Tax

Income Tax

Income Tax

Sales Tax

Sales Tax

TDS

TDS

GST

GST

Service Tax

Service Tax

VAT

VAT

Tax Calculator

Tax Calculator