How to verify your Income Tax Return Filing

The process of filing for Income Tax Returns is becoming easier and quicker through e-filing with many taxpayers opting for it.

ITR-V is referred to the Income Tax Return Verification Form which is a single page document. A taxpayer receives ITR-V during filing of Income Tax Return online. ITR-V Form is filled and then sent to Income Tax Department who will verify the authenticity of the application.

ITR-V can also be defined as an acceptance slip generated after filing for Income Tax Return online. As per the Income Tax Act of 1961, for claiming Income Tax Returns, ITR-V must be signed and sent to the Department of Income Tax, Central Processing Centre, Bangalore via ordinary post or speed post. When the ITR-V form gets generated, the taxpayer should download the form and open it. The password required for opening Form ITR-V is a combination of the taxpayer’s Permanent Account Number and his/her Date of Birth.

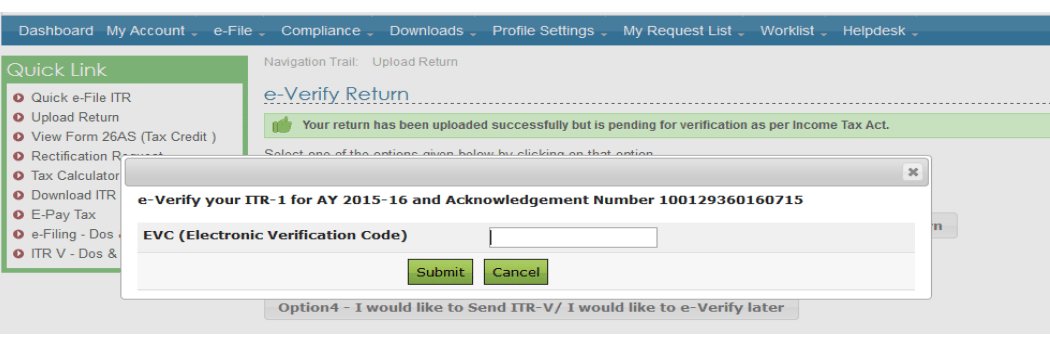

Electronic Verification Code for Verifying E-Returns

The Central Board of Direct Taxes in India recently announced that every taxpayer filing for Income Tax Return online will no longer be required to send the ITR-V Form to CPC Bangalore if the taxpayer has Aadhar Card. The taxpayer’s Aadhar Card can now be used for the verification procedure. As an alternative of manual verification, a new form of verification known as Electronic Verification Code has been launched for verifying the e-returns.

- The taxpayer must mention his/her Aadhar Card number on the Income Tax Returns Form.

- After mentioning the Aadhar Card number, the taxpayer will receive an OTP number on their registered mobile number.

- Finally, the taxpayer must enter the OTP for verification.

Procedure for filling ITR-V Form via CPC, Bangalore

- The ITR-V should be printed clearly using dark blank ink and contain the original signature of the applicant, signed in blue coloured ink.

- The signature should not be marked on the bar code of the Form.

- The bar code and the numbers below it should be clearly visible.

- Do not staple Form ITR-V or fold it.

- Form ITR-V should be enclosed in an A-4 sized, white coloured envelope.

- The envelope containing the ITR-V Form must be mailed to Income Tax Department CPC Post Box No.1, Electronic City Post Office, Bangalore-560100, Karnataka, via speed post or ordinary post within 120 days from the date of post.

- The ITR-V Form should not be posted by courier.

- There is no requirement for any supporting documents except for the signed ITR-V.

- Upon receiving the form, CPC Bangalore (now Bengaluru) will dispatch an email, acknowledging that the form has been received.

- Finally, the acknowledgment e-mail from CPC must be forwarded to the email ID mentioned in the ITR.

Get the detail process of Income Tax Return Verification (ITR-V Form) Get Details

If a taxpayer does not submit the ITR-V within 120 days, then the e-filing will be considered as invalid and the taxpayer will have to file a revised return, fill a new ITR-V then submit it within 120 days.

Frequently Asked Questions

The ITR-V or Income Tax Return–Verification Form, on the other hand, is supposed to be furnished to state that the details in the form filed by the taxpayer are verified.

Along with ITR-1 Form the following supporting documents must be submitted:

- A copy of PAN Card of the applicant.

- For salaried individuals, Form 16 is required.

- Form 16A is required for non-salaried individuals.

- Bank statement or bank passbook.

- Form 26AS.

- Proof of investments along with relevant receipts.

- Visit the official Income Tax Department website.

- Login with the registered credentials

- Go to the Account section and choose the assessment period

- Download the ITR-V Form, and get it printed on an A4 sized paper in black coloured ink only.

People Also Searched For

In the News

-

Now, file your tax returns with All India ITR mobile app

Gadgets Now: Technology firms are gearing up to meet tax compliance deadlines with great fervour. All India ITR, an online tax compliance firm launched its e-filing app that works on both Android and iOS.

14th June 2017

Gadgets Now

Tax

Tax

Income Tax

Income Tax

Sales Tax

Sales Tax

TDS

TDS

GST

GST

Service Tax

Service Tax

VAT

VAT

Tax Calculator

Tax Calculator