How to pay due tax in simple steps

What is Due Tax?

While filling income tax returns, some of us see tax due message in our returns. We get this message when we are not able to estimate our tax dues or where the TDS deduction from the clients or employers haven’t been sufficient.

Prepare Early for next ITR filing

- Least complicated ITR e-filing in the industry

- E-file your ITR in a few simple steps

- Expert Assistance over Chat and Email

- Click to go through the procedure for e-filing here

Why we get Due Tax message?

Inadequate TDS Deduction

You can get a Tax Due Message, if the TDS deduction is not adequate. Sometimes estimates of employers and clients go wrong. It happens when you don’t reveal your income from interests from fixed deposits or income from some freelance projects you have done, then you are required to pay additional tax.

Not revealing income from other sources

There are times, when you failed to properly recognise the income tax bracket you are falling in. Let say you’re earning Rs 4, 80,000 from salary and paid the tax accordingly but you didn’t disclose Rs 80,000 you earned from freelance work. Apart from adding to your taxable amount this addition can also change your tax bracket and you’re required to pay a different percentage of tax. Thus you receive a tax due message from income tax department.

Failing to recognise your tax bracket

Your fixed deposits are taxed just like salary income. And your bank deducts TDS if the interest amount from fixed deposit is more than Rs 10,000. So the taxpayers falling in 20% or 30% tax bracket are required to pay additional taxes. So they get the message.

Not submitting investment proof to your employer

Sometimes employees change jobs and don’t submit proof of investment to their current employers. As a result employer takes minimum exemption and Section 80C deductions into account. Hence they couldn’t deduct the tax they should have deducted. So the taxpayer get a message.

Wrong entries in e-filing

At times it also happens due to wrong entries made while e-file Income Tax Return. So you should check the entries again.

Pay Income Tax Online: Complete Details and Steps Discussed Get Details

What to do if you get the Due Tax message?

Getting tax due message is not very uncommon, if you have also got the message, then check the following:

- Check your details entered and make sure that you have not missed the deductions and TDS.

- Did you receive interest from fixed deposits or other sources?

- Do check if your employer deducted the TDS properly. Due to job change the next employer may not have deducted it property.

How to resolve this issue

Even if you have got the tax due notice you don’t need to worry about that. It can be resolved simply. All you need to do is to pay the income tax online on the income tax department’s official website. After paying the tax, log back into e-filing portal and make an entry in the income tax return in “Self-Assessment Tax” using Challan 280.

Repercussions of not filing Due Tax until the very end

Keeping tax due until the very end is bad practice and you should avoid it all cost. If you have received the tax due message it is good to pay it as soon as possible. Failing it you won’t be able to file ITR. Interest is charged on delayed payment.

How to Pay Due Tax

Paying tax due is simple and you can do it by following some easy to understand instructions. Here we give a step by step guide to paying tax due.

Step by step instructions to pay Due Tax

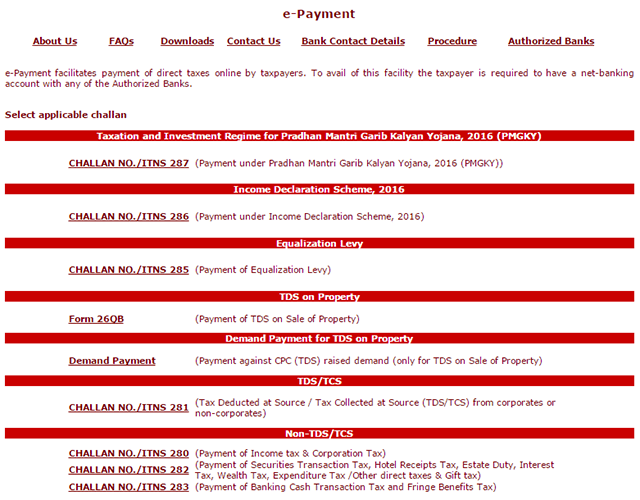

Step 1: Select Challan 280

Go to income tax department website and select challan 280.

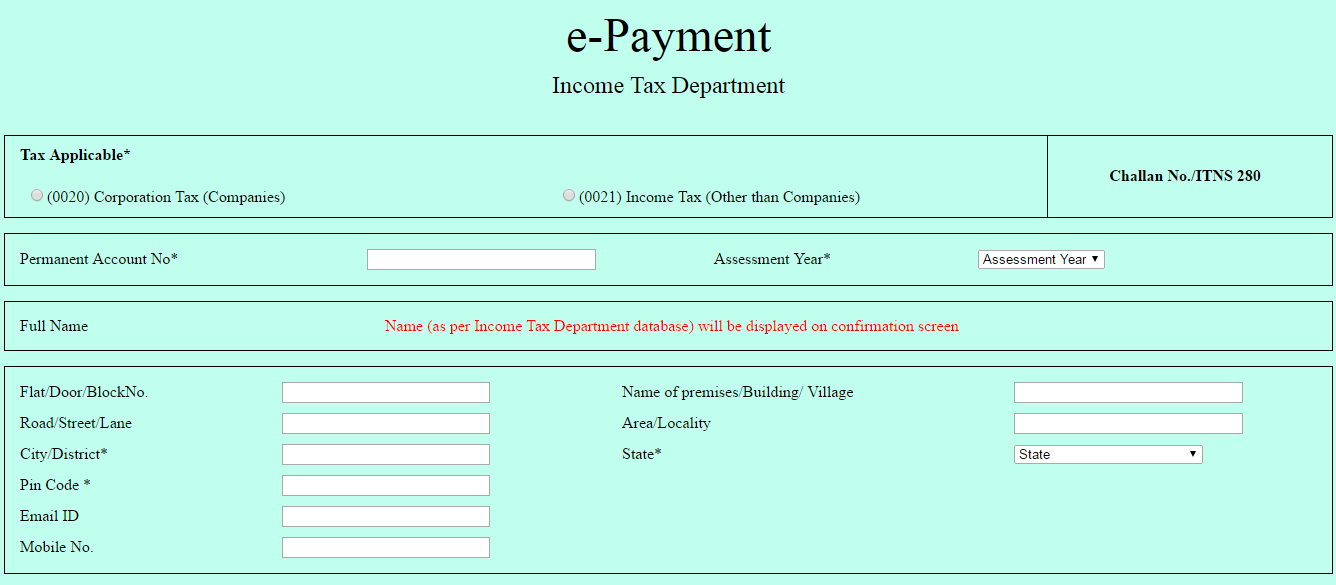

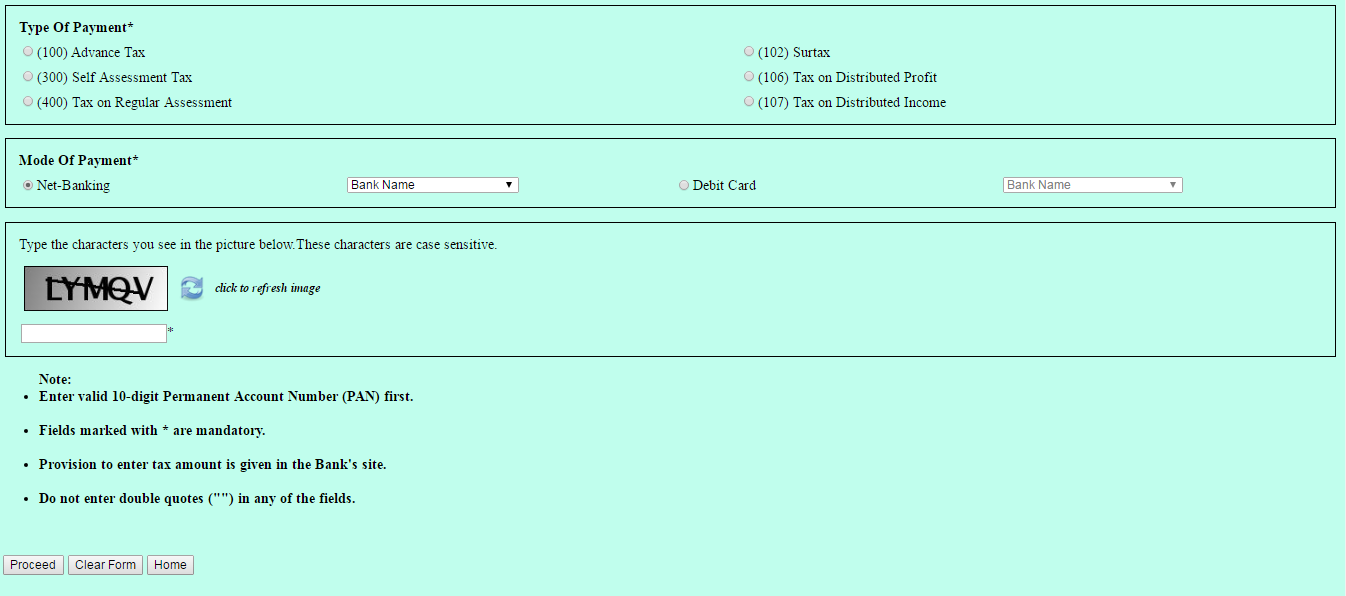

Step 2: Fill your details

Once the form opens enter all the required details and select financial years. Cross check the details provided and click the proceed button.

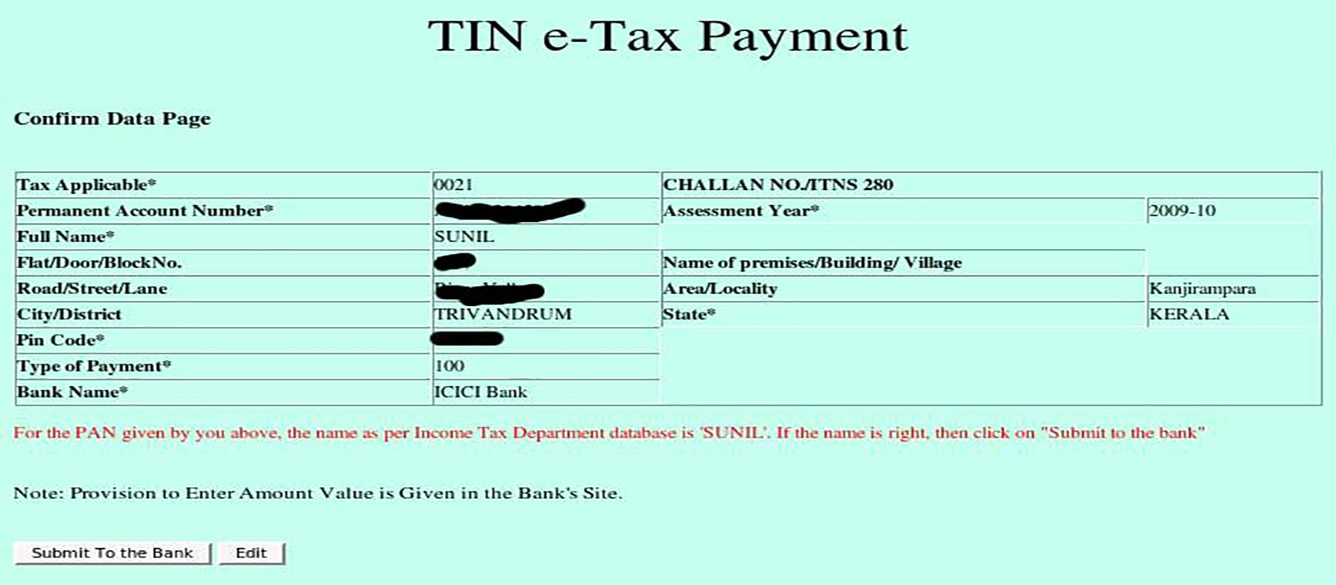

Step 3: Check the details as entered on the portal

Once your click the proceed button you will be redirected to a form containing all your details entered. Cross check all your details and if you find it correct click ‘Proceed’ button.

Step 4: TIN e-TAX Payment

Once you click the ‘Proceed’ button TIN e-TAX Payment is generated. Check your particulars and if these are correct, click ‘Submit to the Bank’ button.

Step 5: Log into your account and pay

On clicking ‘Submit to the Bank Button’ you will be directed to your chosen banks interface. Log into your account with user id and password and make the payments.

What is the proof that you have paid the tax that was due?

Once your payment is successful a receipt will be immediately generated. The receipt contains the details of the persons paying tax. The amount paid, type of payment and Challan Identification Number (CIN) is also mentioned on the receipt or counterfoil. Save a soft copy CIN and use this for further references. You CIN contains seven digit BSR code of the bank branch, date of deposit and serial number of challan.

Step by step instructions for E-payment of income tax Get Details

Due Tax Paid: Now Report it

Once you paid the due tax, it is time to report it. You should report this information in your income tax return.

Due Tax and Salaried Employees

Sometimes salaried employees also wonder whether they can get notice for Due Tax. Generally it doesn’t happen as their taxes get deducted at source. Hence there is no due tax. But if you are getting income from sources other than salary, that includes income from house property, income from capital gains, income from shares among others, then you are liable to pay taxes.

Advance Tax

You’re required to pay advance tax, if you earn a salary and have other sources of income like interest on deposit and your tax liability for the year is more than Rs 10,000 after TDS deduction by your employer. This tax should be paid in the financial year preceding the assessment year. The tax should be paid in three instalments and the due dates are 15 September, 15 December and 15 March.

Self-Assessment Tax

Self-assessment tax is required to be paid in the assessment before you file the income tax returns. While calculating your tax liability if you find that some tax is due after taking into account the TDS and advance tax, then this self-assessment tax is required to be paid. There is no specific due date to pay this tax and it can be filed using a tax challan ITNS 280 at specified bank branches. It can also be filed online.

Description

At times, we see Due Tax message in our tax filing accounts that leaves us worried. Here’s a detail account of what is due tax and how can we deal with it.

Tax Guidelines

Tax Guidelines