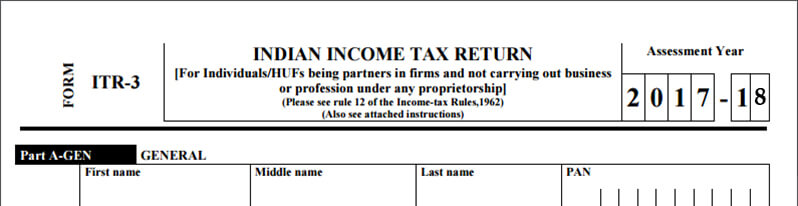

ITR-3: Eligibility, Form Structure, Filling Instructions

We give here, a brief overview of income tax return filing using ITR-3 including who must fill ITR 3, the main parts of the form and instructions to file ITR-3. You need to e-file your returns from FY 2016-2017 (AY 2017-18).

ITR-4 used in FY 2015-2016 (AY 2016-17) is NOW ITR-3

Who must fill ITR-3?

This Income Tax Return Form is meant for all those individuals and kartas of Hindu Undivided Families who may be partners in any business except a proprietorship.

The following categories of taxpayers need to fill ITR-3:

- Individual or karta of HUF who is also a partner in a firm

- Where income chargeable to income-tax under the head "Profits or gains of business or profession" does not include any income save for earnings from interest, salary, bonus, commission or remuneration, due to, or received by him from such firm.

- In case a partner in the firm does not have any income from the firm by way of interest, salary, etc. and has only exempt income by way of share in the profit of the firm, the assesse shall use this form only; not Form ITR-2.

Who must NOT Use the ITR-3 Form to File their Income Tax Return

That individual or HUF who has to report earnings from profits or losses on business via a proprietorship firm.

How to e-verify your income tax returns Get Details

Brief Listing of all the parts of Form ITR-3

This form can be broken into 2 parts and 23 schedules:

- Part A – General Information

- Part B – Calculating total income and taxable income.

The 23 schedules are:

- Schedule-S: Income to be entered in the field ‘Salaries’.

- Schedule-HP: Income to be entered in the field ‘Income from House Property’.

- Schedule-IF: Information about the partnership firm(s) in which taxpayer is a partner

- Schedule-BP: Income to be entered in the field "profit and gains from business or profession" (earnings from salary, interest etc. from firms in which taxpayer is a partner)

- Schedule-CG: Income to be entered in the field Capital gains.

- Schedule-OS: Income to be entered in the field ‘Income from other sources’.

- Schedule-CYLA: Reporting income after adjusting set off for current year losses.

- Schedule-BFLA: Reporting income after adjusting set off for unabsorbed loss carried forward from previous years.

- Schedule- CFL: Declaring losses to be brought forward in later years.

- Schedule-VIA: Reporting tax deductions (from total income) as per Chapter VIA of IT Act.

- Schedule 80G: Declaration of donations entitled to tax deduction under section 80G.

- Schedule SPI: Reporting income accrued in the name of spouse / minor child / son’s wife or any other person or association of persons and which must be included in the income of taxpayer in Schedules-HP, BP, CG and OS.

- Schedule-SI: Reporting income which is chargeable to tax at special rates.

- Schedule-EI: Reporting Income not included in total income (exempt incomes).

- Schedule-IT: Reporting payment of advance-tax and tax on self-assessment.

- Schedule-TDS1: Reporting tax deducted at source from salary.

- Schedule-TDS2: Reporting tax deducted at source from income other than salary.

- Schedule TCS: Reporting collected at source.

- Schedule-FSI: Reporting income accruing or arising outside India.

- Schedule- TR: Declaration tax relief claimed under section 90 or section 90A or section 91.

- Schedule- FA: Declaration of Foreign Assets owned by the assessee.

- Schedule-5A: Reporting apportionment of income between spouses as given in the Portuguese Civil Code.

- Schedule-AL: Reporting positions of Asset and Liability at the end of the year. This is mandatory if your total income exceeds Rs.25 lakhs.

Easy Tax Return Filing For Non Residential Indians Get Details

Filling the ITR-3 Form

Filling instructions for ITR-3

- If any schedule is not applicable respond as “---NA---".

- If any item is inapplicable, put “NA" against that item.

- Put “Nil" in place of the number 0.

- Except as provided in the form, if there is a negative figure / figure of loss, put “-" before that figure.

- All figures should be rounded off to the nearest single rupee. However, the figures for total income / loss and tax payable must be finally rounded off to the nearest multiple of ten rupees.

Filling Sequence for parts and schedules

The Income Tax Department advises assessees to follow the sequence mentioned below while filling out the income tax return form:

- Part A- General info on page 1

- Schedules

- Part B-TI and Part B-TTI

- Verification

This form can be filed with the Income Tax Department using the methods listed below:

Offline method for ITR verification:

- By furnishing the return in a paper form

- By furnishing a bar-coded return

An acknowledgment will be issued at the time of submission of your physical paper return by The Income Tax Department. The acknowledgment slip must be duly filled that is attached with the form.

Online / Electronic method or e-verification:

- By filing the return electronically using a digital signature

- By communicating the data electronically

- Submitting the verification in Return Form ITR-V

The ITR-V should be printed in two copies, of which one should be signed by you and sent to the CPC office in Bangalore. The other one must be kept by you for record.

It is compulsory to e-file income tax returns electronically/online for the following kinds of taxpayer:

- A resident taxpayer possessing any foreign assets or a signing authority on an account in another country, has to fill out schedule FA and furnish the return online.

- Those who earn more than INR 5 lakhs per year.

- Assessees claiming relief under section 90 / 90A / 91 in must apply via Schedule FSI and Schedule TR.

Instructions

- Note that you do not need to send any Annexures with the ITR-V (ITR verification form)

- No attachments or documents including TDS need to be submitted along with the form ITR-3

- Super Senior Citizens (older than 80 years) and those with incomes under Rupees 5 lakh to report in FY 2017-18 without claims to refund may file their income taxes offline.

- Income under the head, ‘Business or Profession’ exceeding Rupees one crore (if business) or Rupees 50 lakh (if profession) in any past financial year under Section 44AB and other similar sections require a compulsory audit done by a chartered accountant and have a different last date for ITR filing.

Read More About

Types of ITR Forms

Types of ITR Forms