Structure of Form 26AS in India and its significance for Taxpayers

Form 26AS, also referred as Annual Statement, is a secured tax statement which contains details of any tax related information like, TDS, TCS, refund etc. that are interlinked with a Permanent Account Number. Form 26AS displays the amount of taxes that have been paid on one’s salary, pension fund, income from interest etc. to the government. This form is also helpful is providing detailed verification of the Tax Deducted at Source (TDS), Tax Collected at Source (TCS), Advance Tax Payment, Income Tax Refunds and all the higher amount transactions debited on behalf of the taxpayer.

Prepare Early for next ITR filing

- Least complicated ITR e-filing in the industry

- E-file your ITR in a few simple steps

- Expert Assistance over Chat and Email

- Click to go through the procedure for e-filing here

Understanding Form 26AS

Salaried individuals basically make payments on taxes in the structure of Tax Deducted at Source or TDS. This amount is deducted by the employer from the employee’s salary every month.

Every tax paid by a taxpayer is recorded on a database by the Department of Income Tax and Form 26AS is the annual statement in which all the details of the tax credit is maintained securely. The tax credit against the Permanent Account Number of the taxpayer is reflected on Form 26AS.

Get View Details, Structure & Downloading of Form 26AS Get Details

A Taxpayer can make claims on the credit of taxes which is disclosed in his / her Form 26AS as per the policy established by the Income Tax Department.

A Form 26AS with respect to a financial year will include details of:

- Tax Deducted at Source (TDS).

- Tax Collected at Source (TCS).

- Advance Tax Paid, Self-Assessment Tax or Regular Assessment Tax which have been deposited in the bank by the taxpayer.

- Refunds details, if a return has been issued by the Income Tax Department.

- Details of Annual Information Report (AIR) Transactions.

- Tax Deducted at Source upon the sale of immovable property and this is applicable for both the buyer & seller.

Breaking down the Structure of Form 26AS

Form 26AS is basically divided into Part A, Part B and Part C.

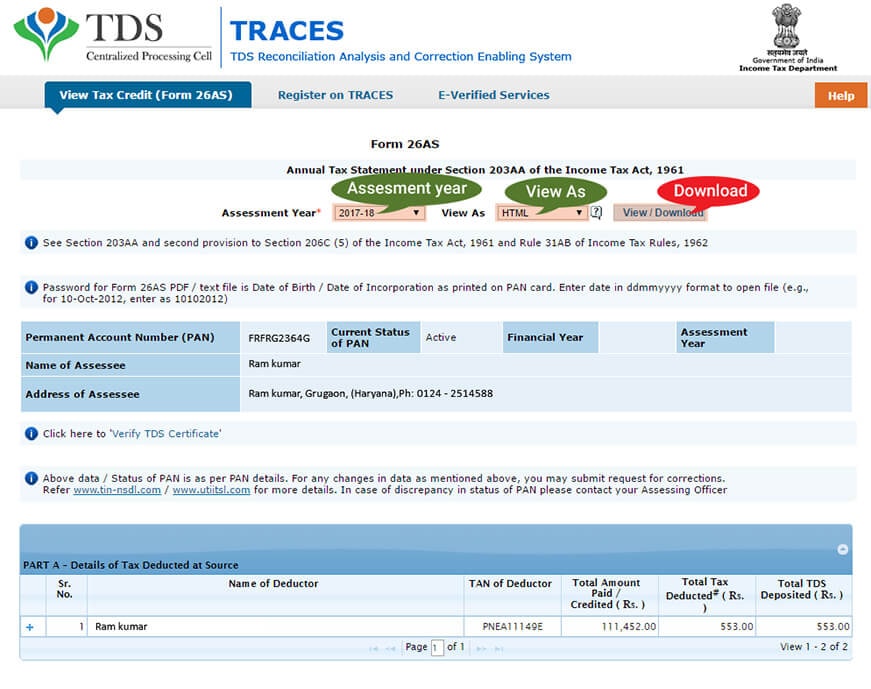

Part A: Part A contains details inclusive of the Tax Deducted at Source (TDS). It will comprise all the details of every tax deduction that have been done at source from an individual’s salary, pension income, and interest rate earnings. It also contains credentials of the deductor (name and TAN) and the amount of tax deducted.

Part B: Part B of Form 26AS contains information about the Taxes Collected at Source (TCS). The collection implies to the taxes collected by seller or merchant against goods that are sold to customers. Part B also gives a detailed record of the seller and the taxes that have been collected.

Part C: Part C comprises of details for the Direct Tax paid by the taxpayer. These taxes include Advance Tax, Self-Assessment Tax as well as details of the challan through which the tax was deposited.

What are the ways to access Form 26AS?

There are two ways to access Form 26AS and both the methods can be done online.

Traces: A taxpayer can access his / her Form 26AS for viewing and analyzing it through TRACES facility which means, TDS Reconciliation Analysis and Correction Enabling System. For availing this facility, a taxpayer must first register on TRACES through the following steps:

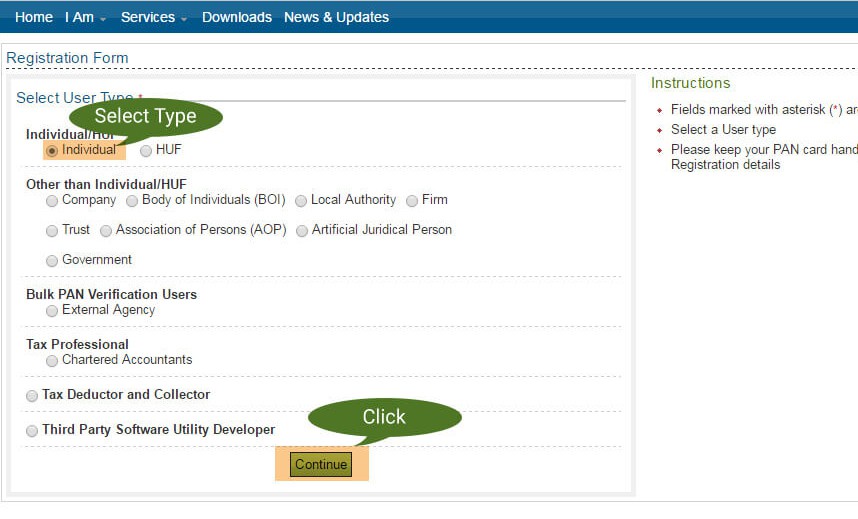

Go to the Income Tax Department e-filing website and locate the Form 26AS from the website.

Select the User Type from the list and click "Continue".

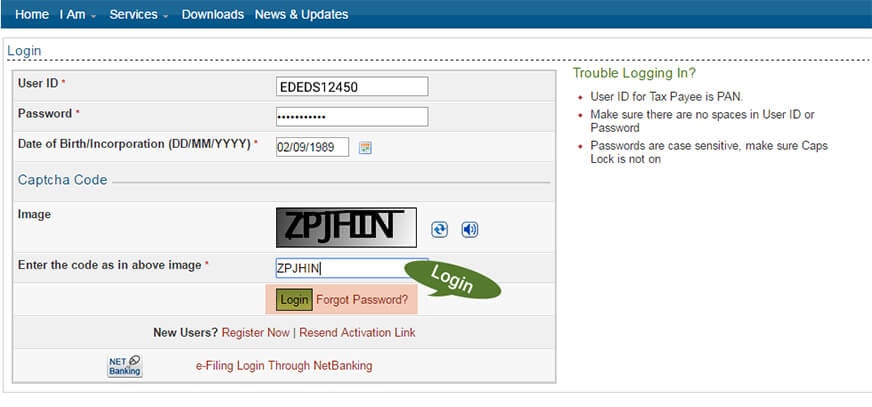

Log in to your account by entering details like your Permanent Account Number, password, date of birth or date of incorporation. Unregistered individuals must first register themselves to gain access to one’s personal account.

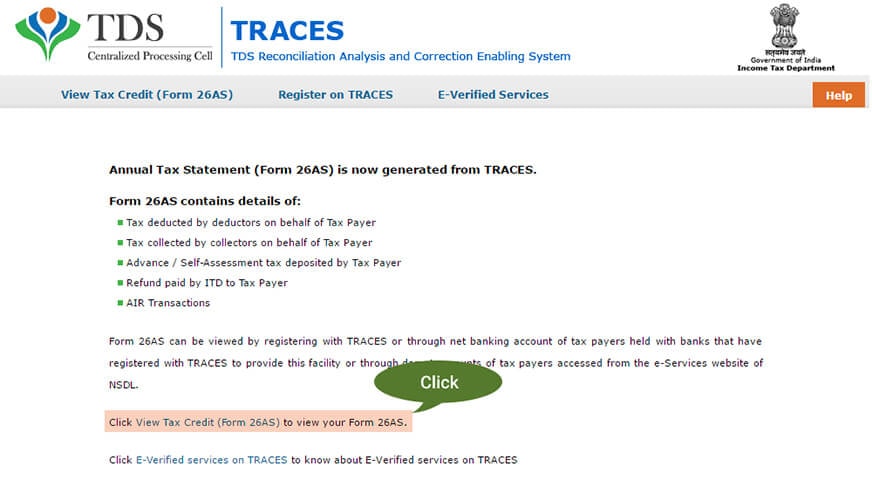

Click ‘View Tax Credit (Form 26AS) to view your Form 26AS’ under ‘My Account’

Click on ‘Confirm’ to get redirected to the TDS-CPC website.

It will direct to TDS-CPC section. Click ‘Proceed’.

Click ‘View Tax Credit (Form 26AS)’ to view your Form 26AS.

Select the assessment year and the format (HTML, PDF and Text) in which you want to view the form.

Enter the captcha character and click on ‘View / Download’ to access Form 26AS.

Net Banking Facility: A different procedure to view or download Form 26AS is via net banking (online bank transaction). A Permanent Account holder who has access to net banking under an authorized and secured bank can avail this facility. However, this procedure is available only if the PAN is linked to one’s bank account. The service is free and provided only to a list of authorized banks.

What are the benefits of Form 26AS?

In general, taxes are complicated to understand for the common layman, but there is no escaping from taxes for income earning individuals. Every taxpayer pays his / her taxes as per the income and every taxpayer can save on taxes by having a better understanding of the taxation system. Form 26AS plays a big role in giving taxpayers access to the taxes paid, received, the details of the deductor etc. Form 26AS acts as a passbook for Income Tax credits and debits.

Key Factors about Form 26AS:

- Form 26AS is always linked to the Permanent Account Number.

- Registered taxpayers can access Form 26AS and download it from TRACES website.

- One can view the contents of his / her Form 26AS starting from the Financial Year of 2008-2009.

Frequently Asked Questions

Yes, it is advisable that prior to filing for Income Tax Returns one must look at his / her Form 26AS for the following reasons:

- To avoid the liability of demand notice issued by the Income Tax Department.

- For a clutter-free processing of Income Tax Returns and for speedy resolutions on refunds.

Tax Guidelines

Tax Guidelines