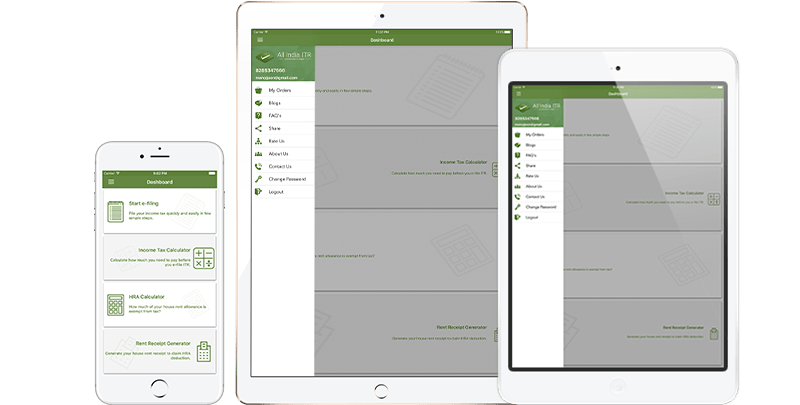

Experience All India ITR IOS app to e-file your income tax return. We are a leading intermediator between the citizen and government for filing income tax return in India. It is free to download and readily available in your iOS app store.

All India ITR IOS App Exclusive Features

Our iOS app is designed specially to meet your need and make your income tax return e-filing easier. Both Individuals and businesses can file income tax return from anywhere and at any time without any hassle via our e-filing mobile app.

The features that our app currently provide are as follows:

-

Easy e-filing ITR: File your Income tax return with our app and avoid hassle.

After installing our app:

- login and click Start e-filing

- Click Individual or Business as per your preference

- Depending on your choice our highly-advanced app will guide you till you finish your e-filing process automatically.

-

HRA Exemption Calculator: You need to calculate your HRA correctly, if you are a salary personal or employee complying with the rent deduction slab, to obtain maximum exemptions. Use our HRA Exemption Calculator to obtain maximum exemption as we have designed our calculating software keeping in hand all the income tax laws.

The lowest of the three HRA exemption amount will be considered as your HRA exempted amount:

- Actual rent paid to the landlord – 10% of the basic salary

- Actual HRA received from the employer

- In metro cities, 50% of the basic salary; and in non-metro cities 40% of the basic salary

-

Income tax calculator: To obtain maximum deduction you need an exact and excellent income tax calculation. Income tax is generally the total amount of your basic salary, HRA, transport allowance, special allowance and all other allowances. You can benefit maximum deduction and exemption from the allowance by calculating your income tax accurately with a clear understanding of the possible deduction slab and tax laws.

With All India ITR iOS app, the long and tedious procedure to calculate your income tax will be overruled by our Income Tax Calculator in our iOS app. It will calculate it for you automatically, easily with excellent results. Our income tax calculator is designed to provide you excellent results keeping in hand the various latest laws and amendments of the Financial Act. To calculate your income tax with our app, follow the guideline after providing the required details in the provided field. Our IT calculating tool is time-saving and easy to use. - Rent Receipt Generator: It is compulsory to submit rent receipt along with the lease agreement and the Landlord’s PAN Card if your HRA is more than Rs 3000/- and rent is more than Rs. 8,333/-per month. You can generate your rent receipt with our iOS app, in the prescribed format to get the possible deduction on Income Tax e-filing. Generate and download the Rent Receipt after filling the details. Fill the information and click Generate and Print/Download your rent receipt.

- Blogs and News: It is very important to keep yourself update before filing any ITR. The laws of Income tax keep on changing / modifying as the situation demands. You can get updates on our everyday Income tax-related blogs and news.

- Feedbacks: The improvement of our service totally depends upon your feedback. Click Rate Us tab on our iOS App, choose the number of stars and share the feedback accordingly.

- Contact us: You can contact us anytime and anywhere with no effort. Our service is available 24 x 7.

- Check Refund Status: It is necessary to keep yourself updated with the return process after filing income tax return. The income tax refund process is a lengthy and time-consuming process, however, with All India ITR iOS App, you can track your refund status within a minute. You can access your refund progress information after 10 days from the submission of the refund claim.

How to check refund status at our iOS App

Step1: Logon to our iOS app

Step2: Go to Refund Status Tab and enter your PAN number, assessment year and captcha words and click Submit

Step3: Your will find your refund status

Note: At present, our iOS App do not support Check Refund Status. It will be available from 1st June’17.

Frequently Asked Questions

To know if your e-return is process by filing with our iOS app you can go to My Order and see your status.

Depending on your e-filing progress you can see your status in:

- Ongoing, if your e-return is processing

- Past, if your e-return is processed

- Cancelled, if your e-return is cancelled.

Error in submission / uploading of return will not happen. If it happens it will be due to server issue or incorrect data or non-filling of mandatory fields.

Please follow the below step to rectify the error:

- You will get a notification if it is server issue. Wait for some time and submit / upload return after some time. While using our app, this issue hardly happens.

- Recatify the errors until there are no further error messages, in case of incorrect data filling. Do not use any Special Characters such as -, _, &,!, ^, <,>, #, ~, %, or * while entering data since it may cause an error while generating XML file or while uploading the XML file.