About ITR-V and Checking Income Tax Refund Status

Income tax return verification or ITR-V is an acknowledgment issued by the IT department upon filing the Income Tax return. The ITR-V form needs to be downloaded, printed off and signed duly by the taxpayer before sending it to the CPC (Central Processing Centre) office in Bangalore. The income tax return process completes only after CPC receives ITR-V. The status of ITR-V receipt can be tracked online through official website of IT department, by entering PAN number, acknowledgment number and assessment year. Tracking can be done to check if CPC has received the acknowledgment or if a refund is processed and status of the processed refund. The tracking facility helps you to monitor if your refund has been processed or not and also keep you informed about the next necessary step you must take to ensure correct refund processing.

Income Tax Return Verification

Verification is the important thing need to be done right after E-filing either using a digital signature or by sending the ITR-V to CPC Bangalore. Income tax return can be verified by two methods, electronic and mon-electronic method.

Verification process through the electronic method

- Log into your account on official portal of IT department.

- Go to the menu and click on "E-Verify Return" option.

- An OTP or One Time Password can be generated by linking Adhaar Card with Pan Number. The OTP will be delivered to the mobile number registered with the account.

Verification process by generating EVC

- Taxpayers with an annual income over INR 5 Lakhs can e-verify their income tax return by this method.

- The electronic verification code (EVC) will be sent to the registered mobile number or email ID and this code can be used to e-verify income tax return.

Verification process through the non-electronic method:

- Download and print off ITR-V acknowledgment form generated after E-filing income tax.

- Duly sign the form and send it to CPC, Bangalore using speed post. You must remember that no other form of mailing except Indian Post will be accepted by CPC.

- The form needs to be sent within 4 months (120 days) from the date of tax filing.

The address of CPC is:

Income Tax Department-CPC,

Post Box No-1,

Electronic City Post Office,

Bangalore-560200, Karnataka

Fail to verify Income Tax Return will not process your filed income tax return and it will be considered as non-filing of ITR.

Downloading the ITR-V

- Access the official website of Income Tax Department and log into your account.

- Click on “View Returns / Forms” and you will see all the ITR you have filed so far.

- Click on the related acknowledgment number and the form will start downloading.

Sending ITR-V to CPC

CPC or Central Processing Unit is situated in Bangalore and process the acknowledgment form for refund issue. Once the ITR-V generates after completing the E-filing income tax process. The ITR-V form requires a password to open it which is a combination of PAN number and DOB of the taxpayer.

Example password:

PAN: ABCDE1234F

DOB: 01/01/1988

Password: ABCDE1234F01011988

The form needs to be downloaded, printed off and signed duly by the taxpayer before sending it to the CPC, Bangalore.

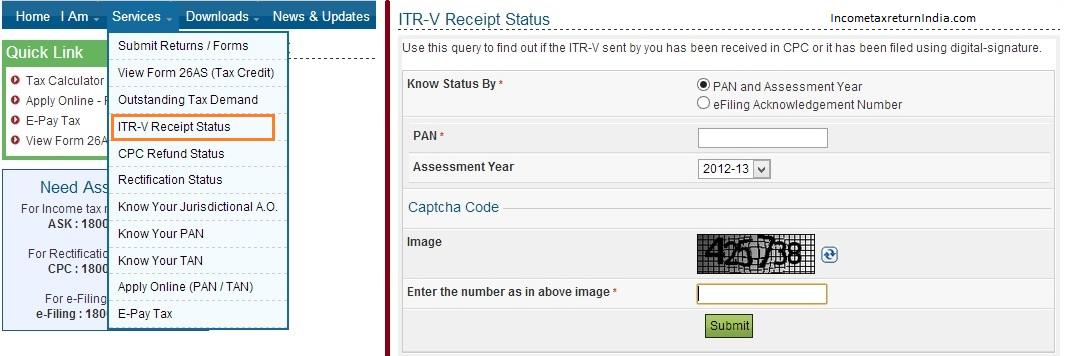

Track Receipt Status of ITR-V

CPC provides tracking facility for the taxpayers and there are multiple ways to do that. Tracking is important as a taxpayer need to be informed about the unfortunate postal loss of the ITR receipt form.

To keep a track on the ITR-V status, you can do any of the following:

- Once CPC receives your ITR-V, they issue a notification email to the registered email ID of the taxpayer. They send the email one month after receiving the ITR verification document.

- Go to the official E-filing website, and click on the “Services” section in there. Enter your PAN number, acknowledgment number and year of assessment in there to track receipt status.

- You can also call CPC, Bangalore by using the toll-free 1800-425-2229 number or 080-22546500.

Track Intimation Status

- One month after receiving the ITR-V, CPC will send an email to the taxpayer confirming receipt. Such intimation is refered under Section 143(1). This mail also contains details such as total paid tax, TDS deducted, other deduction claimed etc along with the difference in any of them.

- This mail contains two column, one shows income tax return paid by the taxpayer and other shows tax calculated as per section 143(1).

- It is recommended that taxpayer must analyse the mail carefully to confirm that all details are given correctly.

- The mail may contain the difference between paid tax and amount calculated by the IT department as referred under Section 156. If such thing happens, then you will have to pay additional taxes.

The meaning of Various Tracking Status

- Filing status – ensure that this status is shown on the tax return.

- Social Security – you must enter IRS or SSN is shown on the tax return.

- Refund amount – the amount to be refunded back must be mentioned in here.

Tracking Income Tax Refund Status

If IT department has calculated tax more than you have paid then you can claim a refund on that. The refund will be issued either through bank cheque or will be transferred to your primary bank account. In such case, you can check the refund status by logging into your account by accessing the official website of the IT department. You can also check refund status on TIN website once the return gets processed by the IT department.

Documents need to be Retained as Proof

One must need to retain IT records carefully as IT Department can initiate any legal proceeding within 6 years.

The documents you must retain are:

- All communication made with IT department including email copy and print out of them

- Copy of Filed ITR

- Copy of ITR-V

- Tax deducted at source (TDS) or Form 16A

- Form 16

- Form 12 B

- Statements of tax exemption

- Bank account statements

- Copy of Challan for tax paid

- Gifts deeds

To get expert tax refund advice, browse www.allindiaitr.com and avail expert assistance.

People Also Searched For

In the News

-

All India ITR offers free income tax filing assistance for personnel of armed forces

The Economic Times Wealth: Vikas Dahiya, founder and chief of tax compliance platform, All India ITR announced a free of cost tax returns solution for members of the Indian Armed Forces. Due to their disciplined schedules, annual tax returns become a hectic chore for servicemen. They need to repaid for their services to millions of citizens and this initiative will go a long way to alleviate the stresses in their service conditions.

18th July 2017

THE ECONOMIC TIMES

Tax

Tax

Income Tax

Income Tax

Sales Tax

Sales Tax

TDS

TDS

GST

GST

Service Tax

Service Tax

VAT

VAT

Tax Calculator

Tax Calculator