ITR-V: Verification form download and offline verification

Outline

ITR-V (Income Tax Return – Verification Form) is an acknowledgement that you receive after filing your income tax return online. It is a one-page document that you need to download it from the Income Tax Department website and submit it to CPC Bangalore after signing it with blue ink. The ITR-V you receive does not imply that you had filed your income tax return online correctly or wrongly. It only implies that you had filed an ITR.

Significance of ITR – V

A taxpayer’s income tax return e-filing will be considered invalid if he/she e-file without the signature. Therefore, the taxpayer should submit the ITR -V to CPC (Central processing Centre), Income Tax Department Bangalore after signing the form.

It is a one-page document automatically sent by the IT department as a verification of the authenticity of the e-filed return. If you share your digital signature while e-filing the return then you don’t need to submit the ITR – V to CPC, Bangalore. However, if you did not share your digital signature you should download and submit the ITR – V to complete the e-filing process.

Download ITR – V

You can download ITR – V form directly from the Income Tax Department website. Follow the following steps to download your ITR – V

Step1: Click Log in here at IT Department website

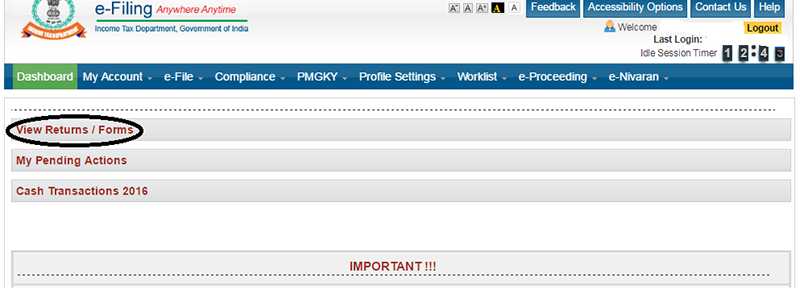

Step2: To see your e-file tax return click View Returns/Forms

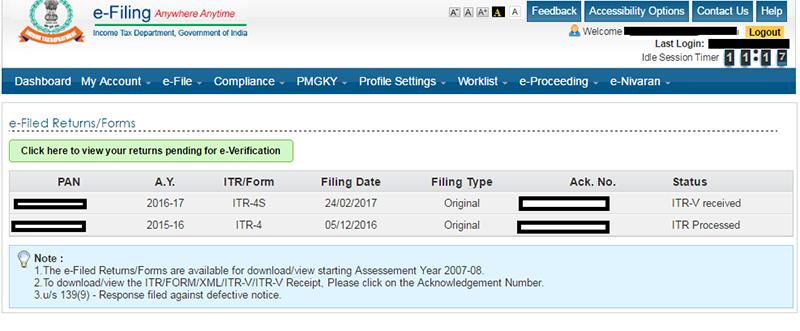

Step3: To download your ITR -V click your acknowledgment number.

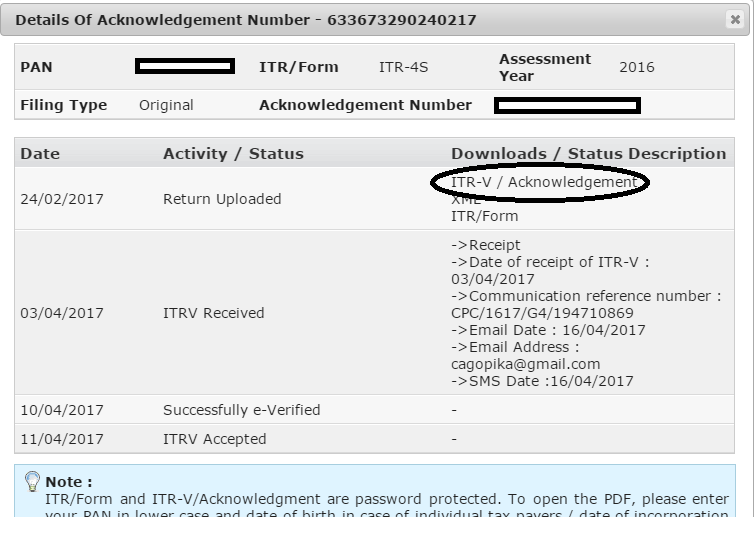

Step4: Click ITR – V/ Acknowledgement and your ITR – V will be downloaded automatically.

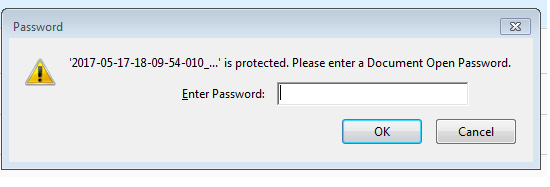

Step5: Enter the password to open the downloaded ITR -V. Your password will be the combination of your PAN number and your Date of Birth.

For example:

PAN: AVNPA1122C

Date of Birth: 05/05/1988

Password: avnpa1122c05051988

Step6: Print the ITR-V, sign it with blue pen only and sent it to CPC Bangalore. You should submit the form within 120 days from the date of e-filing. The address to speed post your ITR-V is –

Income Tax Department - CPC Post Bag No.1, Electronic City Post Office, Bengaluru, Karnataka 560100Instructions you should adhere before sending ITR-V

The Income Tax Department had set some terms and conditions that a taxpayer should adhere before sending the ITR – V to the CPC.

The instructions are as follows

- The taxpayer should use only A4 size paper to print ITR – V

- It should be printed with jet ink/ laser printer to maintain clarity and avoid fading or light print.

- Use only black ink to print the form

- The ITR – V form that you post to CPC should be signed with Blue Ink only.

- Xerox copy of the signature will not be accepted

- Do not type or write anything at the back of the paper

- The barcode and the numbers below it should be visible clearly.

- Do not write anything on the barcode or do not do the signature on the barcode.

- Avoid using stapler on the form

- If you are submitting both original and revised returns, use two separate paper and print the ITR-Vs separately. Do not print the forms on both the sides of a paper.

- You can send more than one form in one envelop

- Avoid any attachment to the ITR-V form. Namely, any annexures, pre-stamped envelopes, covering letter, etc.

- Your ITR-V should reach CPC within 120 days from the day you file your returns.

- Your ITR-Vs will be rejected or the acknowledgement will be delayed if your ITR-Vs do not conform the above-said specifications.

Aadhaar based verification

A new system has been introduced by the Central Board of Direct Taxes (CBDT) where an EVC (Electronic Verification Code) will be sent to the taxpayer based on their aadhaar for authentication. With this system, you can obviate the sending of CPC for verification.

Now Aadhar Made Mandatory to File IT Returns Get Details

It is an alternative way of filing returns or else you can follow the current system, where you send the ITR-V form to CPC Bengaluru or use digital signature while e-filing returns. In case if you do not have aadhaar card you can continue with the current system.

To follow this new system the taxpayer, need to link their PAN with Aadhaar. To link your Pan with Aadhaar follow the below steps

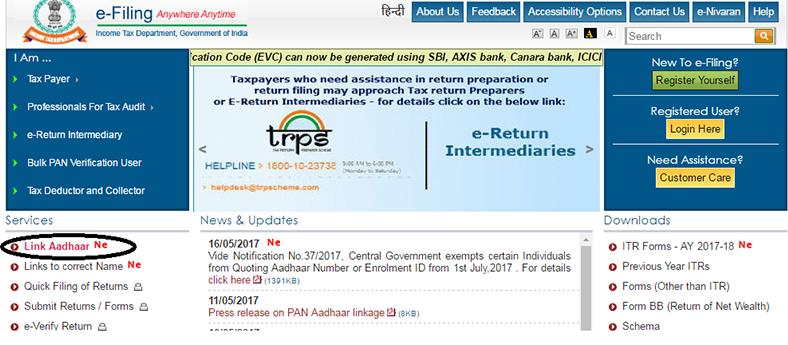

Step1: Go to IT department website

Step2: Click Link Aadhaar

Step3: Provide your PAN number, Aadhaar number and your name given in the aadhaar card without any spelling mistake and submit.

Note: Your link will be confirmed after UIDAI verification. In case of any minor mismatched information provided by the taxpayer, an aadhaar OTP will be required. Moreover, ensure that the gender and date of birth in PAN and Aadhaar card are same. Anyone who wants to link their Aadhaar and PAN can use this facility whether he/she is e-filing or not.

Frequently Asked Questions

However, for the taxpayer who had filed their ITR manually should write an application to AO for a duplicate ITR-V.

If you want to change or update your e-mail id in your ITR-V, then follow the below given steps –

- Log in to your account

- Go to Settings and click Change

- Enter your new e-mail address

- Click Submit

If the taxpayer fails to receive the acknowledgement receipt then he/she can download it from the IT website. Follow the below process to download your acknowledgement receipt –

- Log in to your Income Tax account

- Go to E-filing Processing Status under My Account dropdowns.

You can also check your acknowledgement receipt with your PAN and assessment year or e-filing acknowledgement number at ITR-V receipt status under Services section on the website.

Read More About

In the News

-

Now you can file ITR through your mobile, Government authorized website launches e-filing app

NDTV Khabar: All India ITR’s new e-filing app helps simplify the tax return process for the common man by allowing you to calculate taxable income, exemptions from tax, generate rent receipts and know the status of your refunds.

14th June 2017

NDTV Khabar

Tax

Tax

Income Tax

Income Tax

Sales Tax

Sales Tax

TDS

TDS

GST

GST

Service Tax

Service Tax

VAT

VAT

Tax Calculator

Tax Calculator