How can I get EVC through Net-Banking?

Filing and verifying Income Tax Return has become easier, as a taxpayer can file and verify his Income Tax Return online on the Income Tax Department’s official e-filing portal. Earlier, the taxpayer had to send a copy of ITR-V to CPC Bangalore which was quite time consuming, but now the taxpayer can complete the verification of ITR in no time.

There are multiple ways by which you can generate EVC and E-verify your Income Tax Return. Here are a couple of them: -

- Generation of EVC by E-mail ID and mobile number

- EVC Generation via Aadhaar Card

- EVC generation via Net-banking

- Generate EVC by Automated Teller Machine (ATM)

- EVC Generation by Bank account details

- Generate EVC by Demat account

How to generate EVC via Net-Banking?

Following are the steps to generate EVC through Net-Banking: -

Step: 1

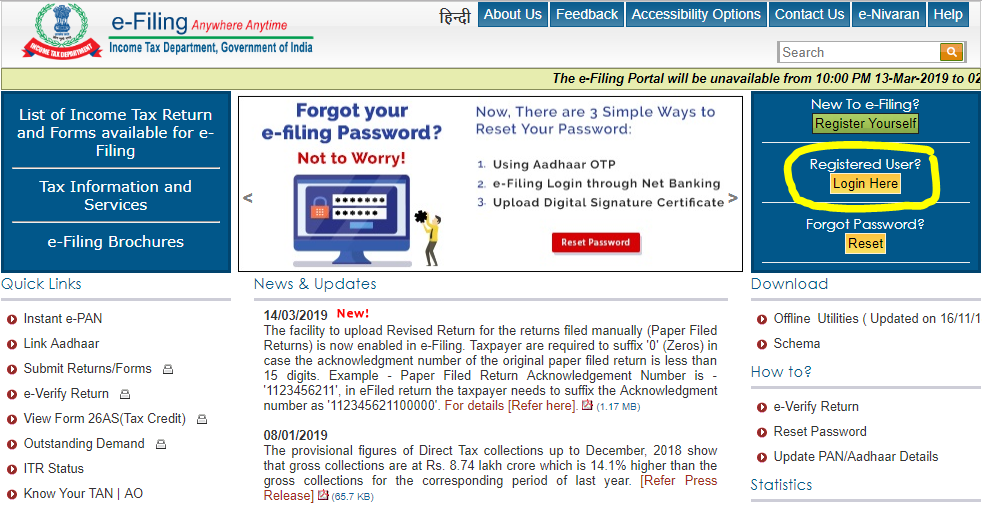

Visit the Income Tax Department’s official e-filing portal.

Step: 2

At the top right corner of the screen, you will find three options. Choose the option that says “Register user” if you haven’t registered into the portal. If registered, click the “Login here” option.

Step: 3

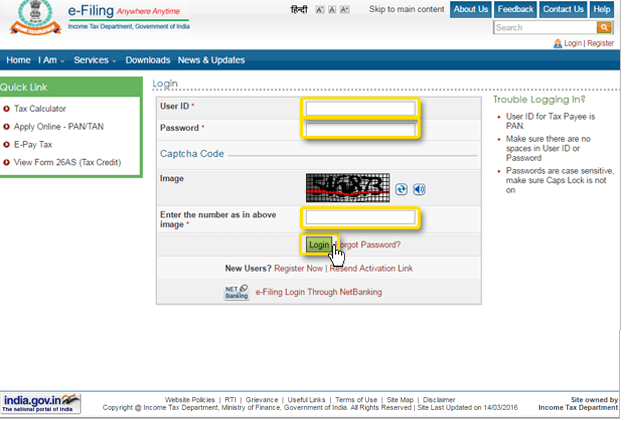

If you have clicked “Login here”, you will be directed to the login page, where you are supposed to furnish your “User ID” and “Password”, along with the “Captcha code” in the given space, then click on the Login button.

Step: 4

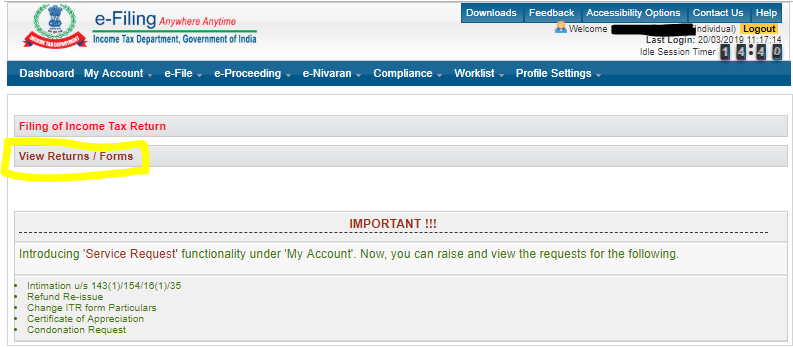

Choose “View Returns/ Forms” tab in the succeeding page.

Step: 5

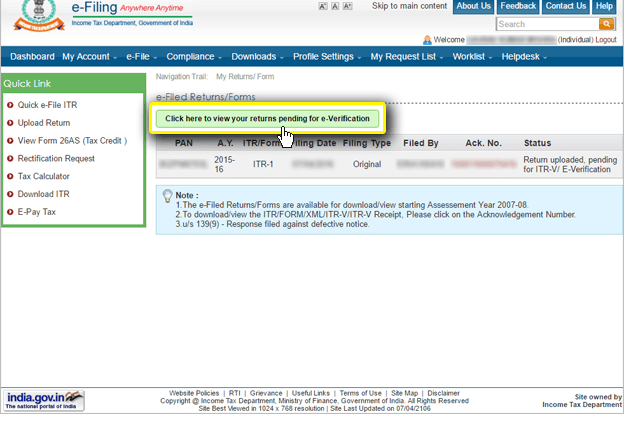

On the next page, you are required to choose “Click here to view your returns pending for e-verification” option, which facilitates the viewing of returns pending to be verified.

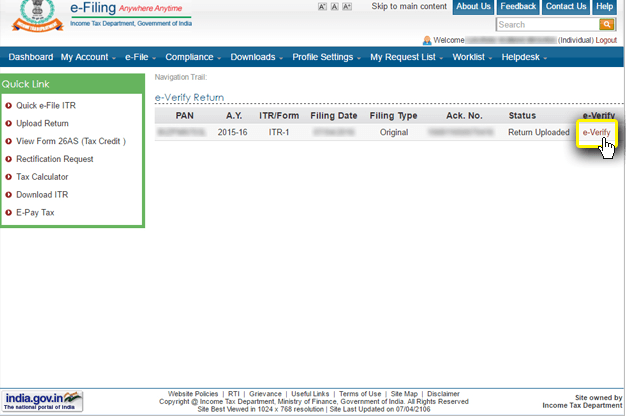

Step: 6

Once you get the list of returns pending to be verified, select the “e-verify” option that is adjacent to the respective returns.

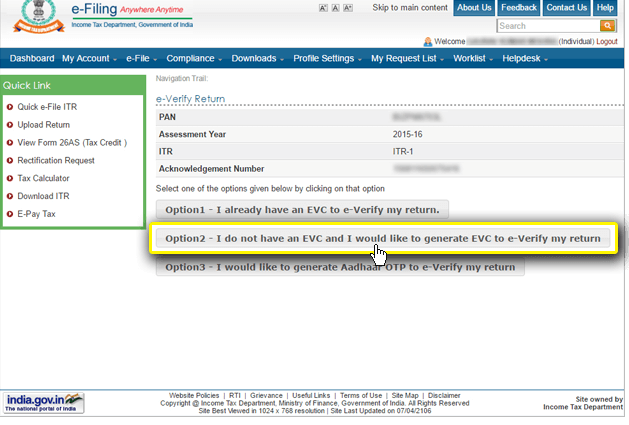

Step: 7

The next page will give you three options, out of which you are supposed to choose “Option 2” which says “I do not have an EVC and I would like to generate EVC to e-verify my return”.

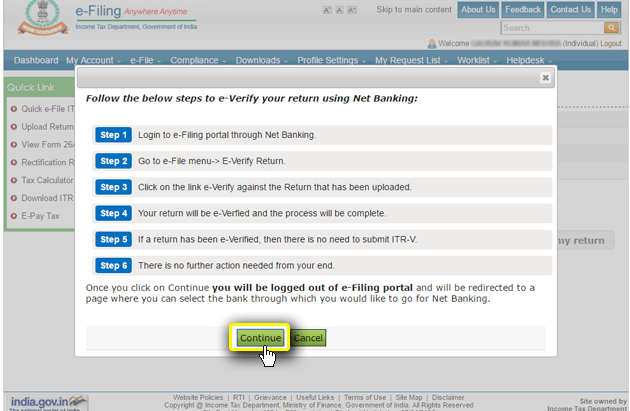

Step: 8

Among the choices provided in the next page, choose “EVC-Through Net Banking” option.

Step: 9

You will be redirected to a page which depicts the procedure to conduct e-verification through this facility. Click on the “Continue” button, in order to visit the net-banking page.

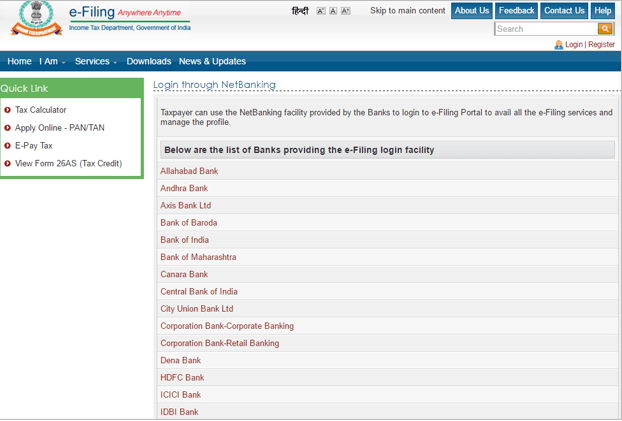

Step: 10

Choose your preferred bank among the choices specified.

Step: 11

Comply with the steps as depicted in the net-banking page of the bank (refer step 9) to obtain EVC and complete the process of verification.