How do I track my GST payment status?

GST or Goods and Services is an indirect tax that is paid by many traders/ dealers for the supply of goods and services. Many of them face problem in tracking their GST payment status and that’s the reason why, we will tell you how you can track the status the GST payment status without hassle.

Steps to track the GST payment status online.

Step: 1

Visit the official GST portal, on the Dashboard, go to the Services tab>>Payments>>Track Payment Status. In order to check the payment status, you are not required to login.

Step: 2

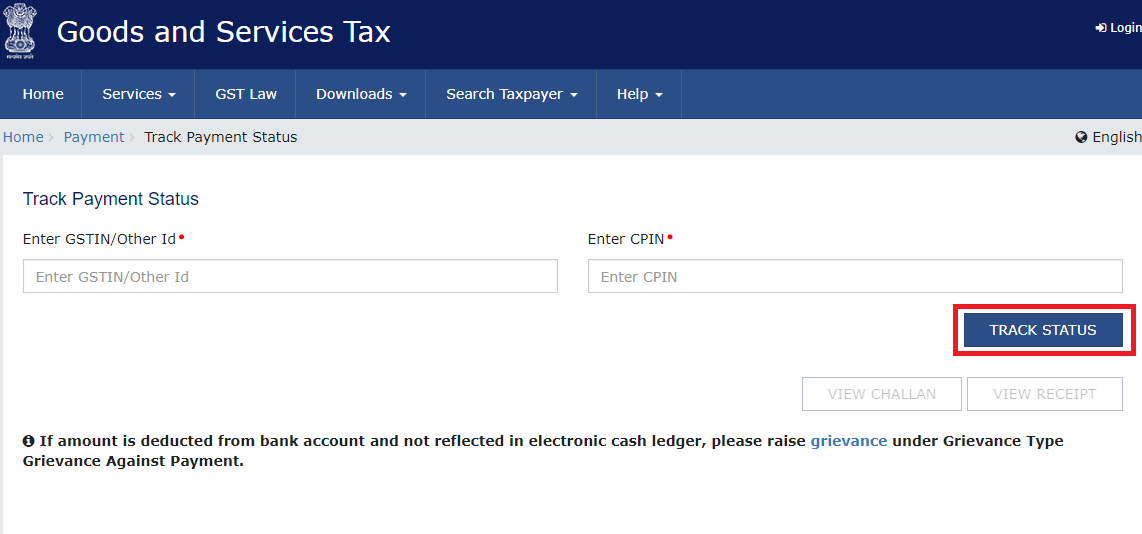

Next, you will have to enter your CPIN and GSTIN, to check your GST Payment status.

Step: 3.A

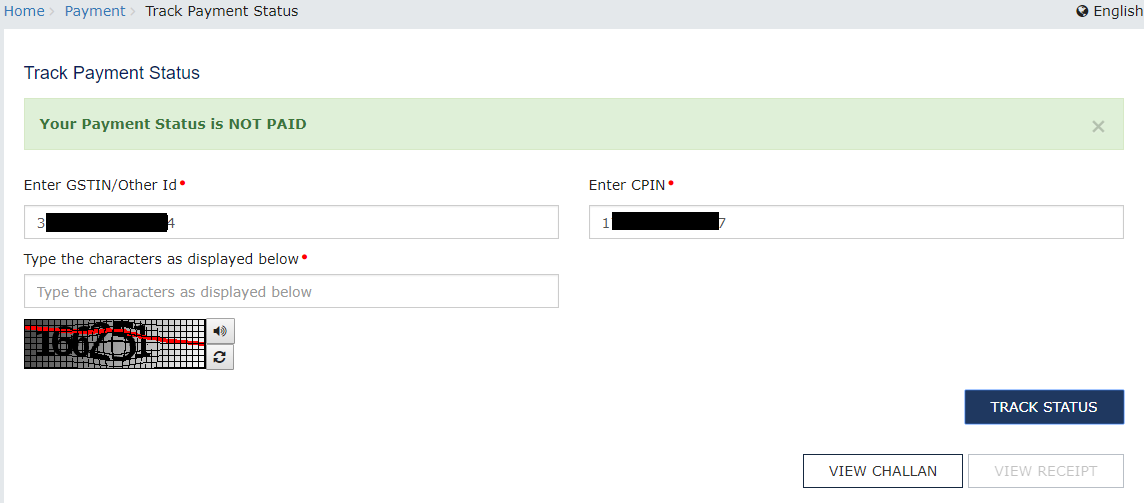

When the status displayed is “Not Paid”, you can save an offline copy by clicking “Download”.

The status displayed on the screen will either be paid or Not paid.

Step: 3.a

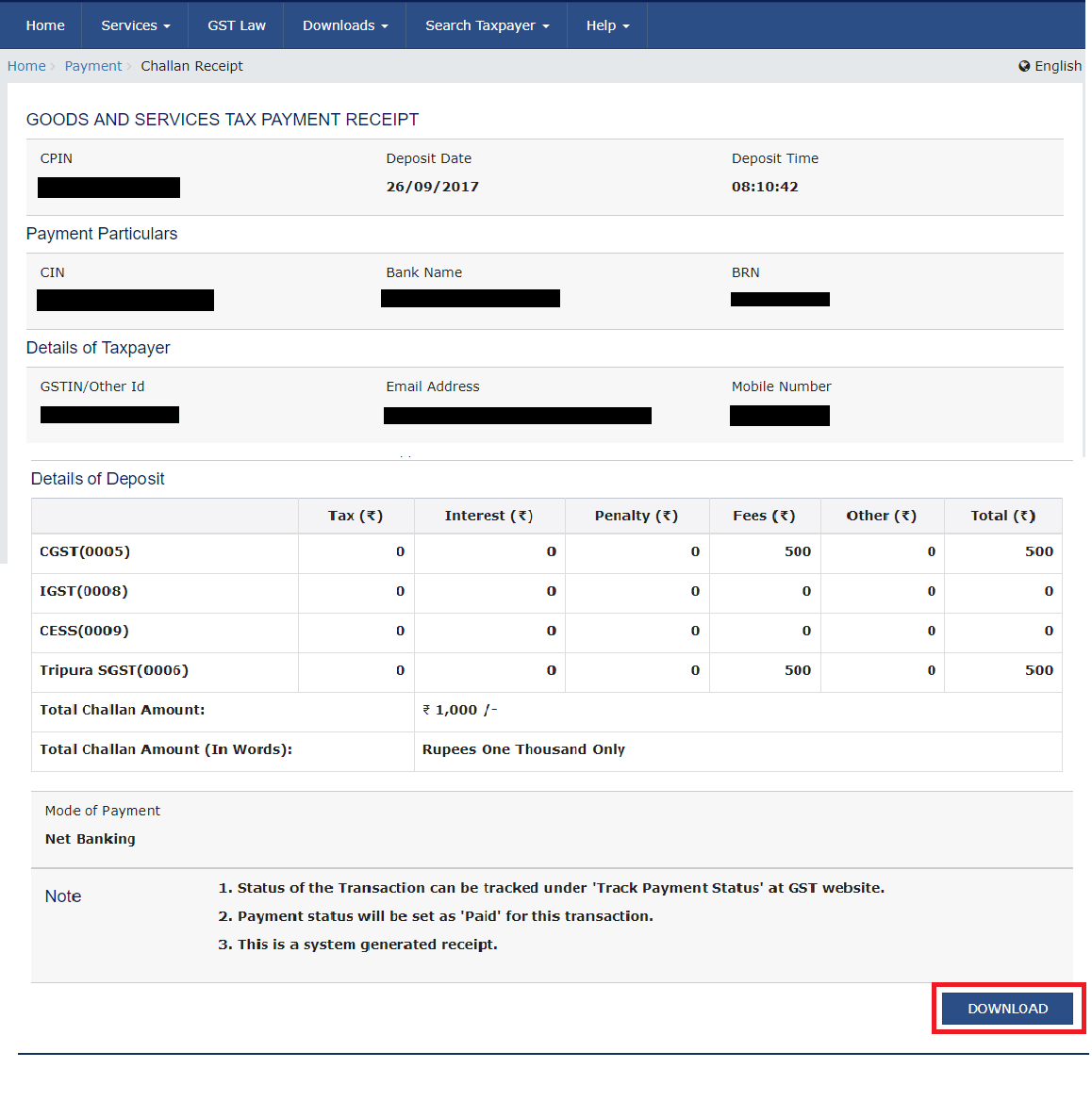

When the status displayed as “Paid”

Step: 3.b

If it is showing as paid, then you can download the receipt. Click ‘View Receipt’ and then ‘Download’.

Step: 3.B

If you want to view the challan click ‘View Challan’. The challan will open as below. You can save an offline copy by clicking “Download”.