Can I make GST payment using Credit or Debit Card?

There are several traders/ dealers who pay GST and file their GST returns on regular basis, there are taxpayers who are liable to pay GST, but don’t know how to go about making the payment, that’s why, we will tell you how you can make GST Payment.

Can I use Credit Card to make GST Payment?

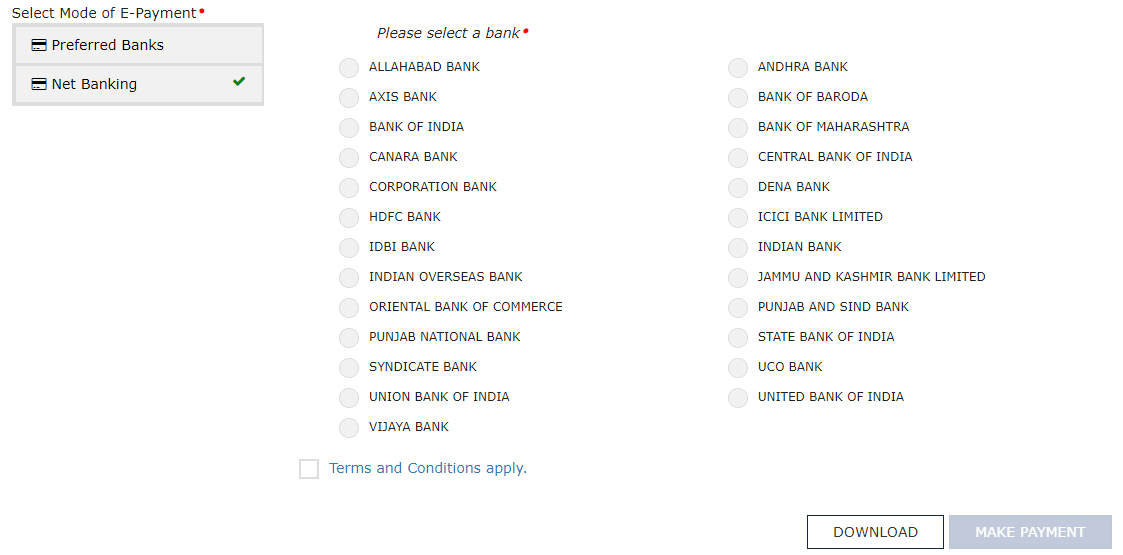

The one thing you need to remember is that, you need to create a GST Challan for paying GST after logging in to the official GST Portal. After that you will see a list of banks through which you can make the payment. You can either make the payment using a debit card or via RTGS/ NEFT. So, you cannot make GST payment using a credit card.

Can I use Debit Card to make GST Payment?

Yes, a taxpayer can use Debit Card to make GST Payment online. Here is the list of banks using which you make the GST Payment: -

- ALLAHABAD BANK

- ANDHRA BANK

- BANK OF INDIA

- BANK OF BARODA

- BANK OF MAHARASHTRA

- CANARA BANK

- CENTRAL BANK OF INDIA

- CORPORATION BANK

- DENA BANK

- INDIAN BANK

- INDIAN OVERSEAS BANK

- ORIENTAL BANK OF COMMERCE

- PUNJAB NATIONAL BANK

- PUNJAB & SIND BANK

- SYNDICATE BANK

- UNION BANK OF INDIA

- UNITED BANK OF INDIA

- UCO BANK

- VIJAYA BANK

- STATE BANK OF INDIA

- STATE BANK OF BIKANER & JAIPUR

- STATE BANK OF HYDERABAD

- STATE BANK OF MYSORE

- STATE BANK OF PATIALA

- STATE BANK OF TRAVANCORE

- IDBI Bank Ltd