How can I get my ITR-V Acknowledgement?

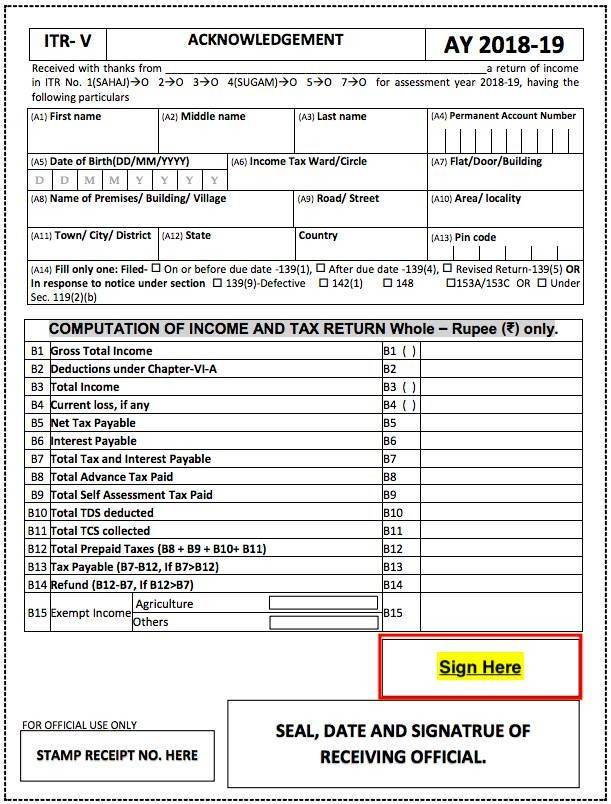

ITR-V or Income Tax Verification Acknowledgement is a one-page document that the taxpayer receives from the Income Tax Department after filing the Income Tax Return. It is sent to the taxpayer’s registered E-mail ID. You can download a copy of ITR-V from the Income Tax Department, the copy of the ITR-V is supposed to be signed and sent to the CPC Bangalore via Speed post, for the completion of the ITR Verification.

How to download ITR-V Acknowledgement?

Once a taxpayer files Income Tax Return, they receive their acknowledgement on their registered e-mail ID, then the taxpayer is required to take a print out of the same, sign it and send it to CPC Bangalore within 120 days of filing Income Tax Return, this is how you can download ITR-V Acknowledgement from the Income Tax Department’s official e-filing portal: -

Step: 1

Login to the Income Tax Department’s official e-filing portal and click on “View Returns/ Forms” link.

Step: 2

Select the option “Income Tax Return” and “Assessment Year”. Click on the “Submit” button.

Step: 3

Click on the acknowledgement number of the income tax return for which you want to download ITR-V.

Step: 4

ITR-V will be downloaded.

Things to remember while sending ITR-V to CPC Bangalore

ITR Acknowledgement is an important part of ITR filing, here are the things that you must remember before sending ITR-V acknowledgement to CPC Bangalore: -

- ITR-V should be printed in a blank ink on a A4 size paper.

- ITR-V should have an original signature of the taxpayer in blue ink.

- The signature should not be on the barcode of the Form. Barcode and numbers below the barcode should be clearly seen.

- You should not use stapler on the ITR-V.

- Do not fold the signed ITR-V.

- Enclose the ITR-V form in an A-4 size envelope.

- Send ITR-V to the CPC Bangalore, the address of the same will be mentioned below the ITR-V, you are required to send it through speed post or ordinary post within 120 days from the date of filing.