What is the ARN Number in GST?

ARN Number is the application reference number that is generated on the official GST Portal automatically after the submission of the GST Registration Application. GST ARN number can then be used for tracking the status of GST registration application until GST Certificate and GSTIN is issued by the Government.

Where can I get GST ARN Number?

GST ARN Number us generated on the official GST Portal, after the submission of GST Registration Application.

How to check GST ARN Number?

Once you have obtained a GST ARN number, the status of the GST ARN can be checked online on the GST Portal. To check the GST ARN status, follow the steps mentioned-below: -

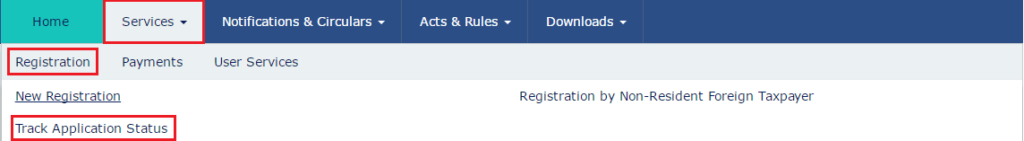

Step: 1

Visit GST Portal and under the main menu, click on Track Application Status under Services.

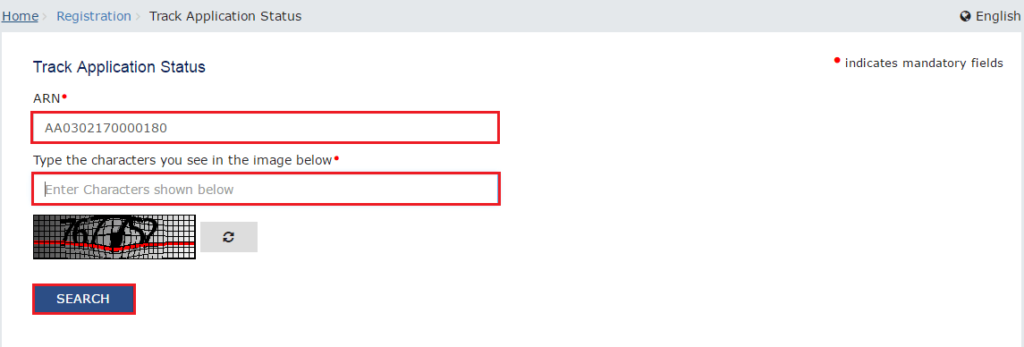

Step: 2

Next, you are required to enter the ARN Number in the given field and complete the Captcha.

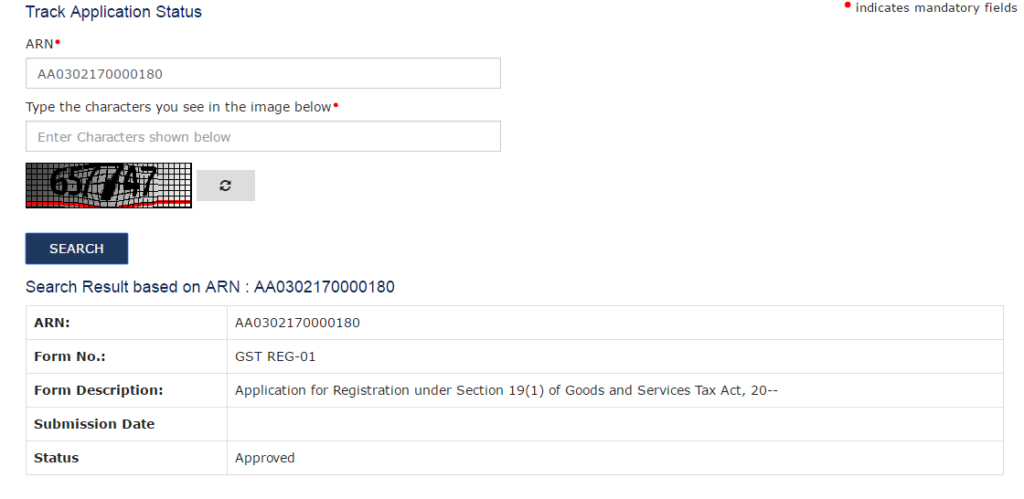

Step: 3

Once you submit the application, the status of your ARN will be displayed on the screen.