How can I download GST registration certificate?

Any business that has a turnover of more than Rs. 20 Lakh is required to register under GST. Moreover, it is mandatory for some special businesses to register under GST. Every registered taxpayer is issued a GST Registration Certificate in Form GST REG-06. If you are a registered taxpayer you can also download the GST Registration Certificate from the official GST portal. The registration certificate is available for downloading only on the GST Portal. The government does not issue any physical certificate.

How to download GST Registration Certificate?

Following are the steps to download GST Registration Certificate: -

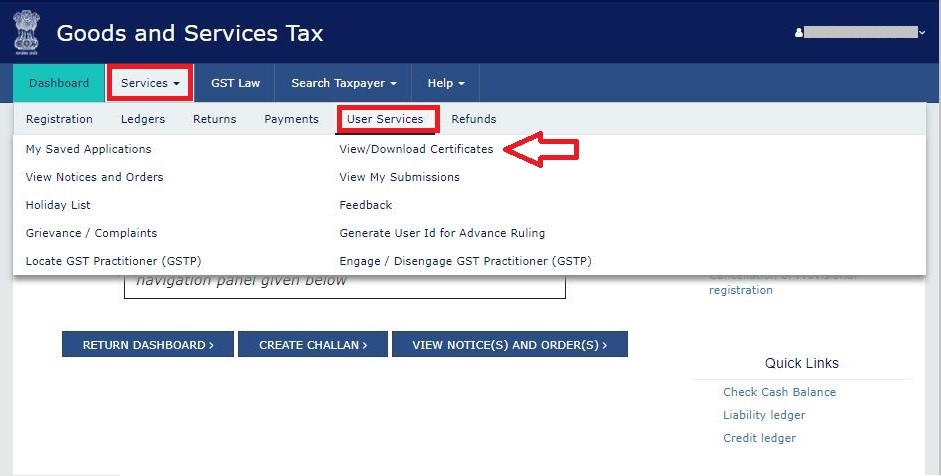

Step: 1

Login to the official GST Portal

Step: 2

Go to ‘Services’ - ‘User Services’ - ‘View/ Download Certificate.

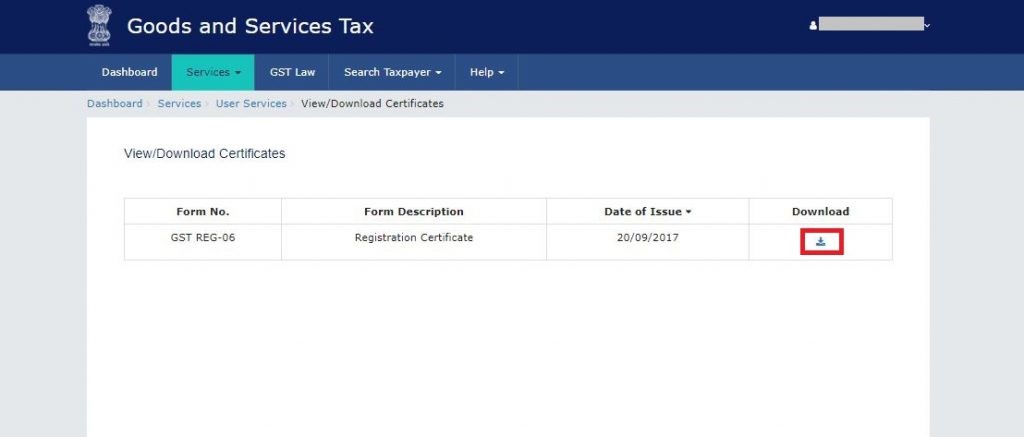

Step: 3

Click on the ‘Download’ icon.

The GST Registration Certificate contains all the details of the business. On the first page, basic details like name, address, and date of registration of the business are mentioned

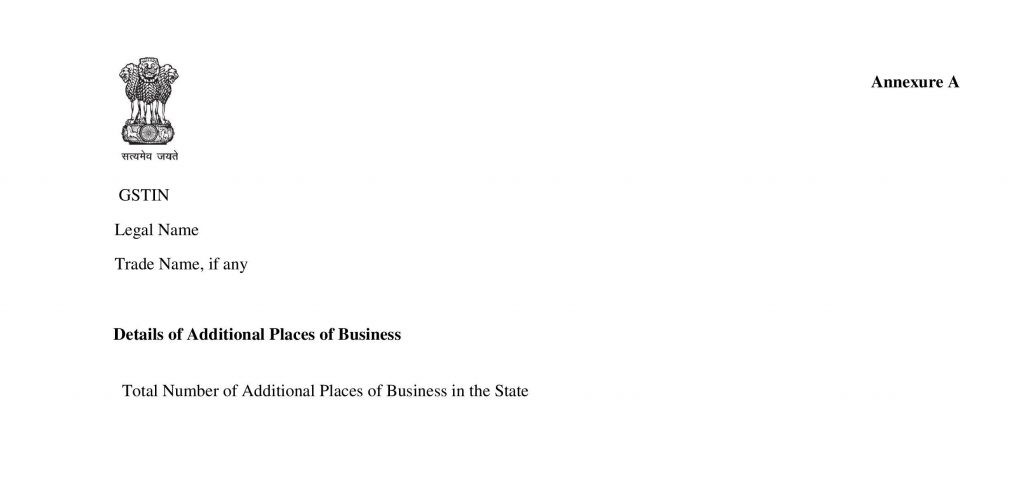

The second page is ‘Annexure A’ which contains details of any additional place of business.

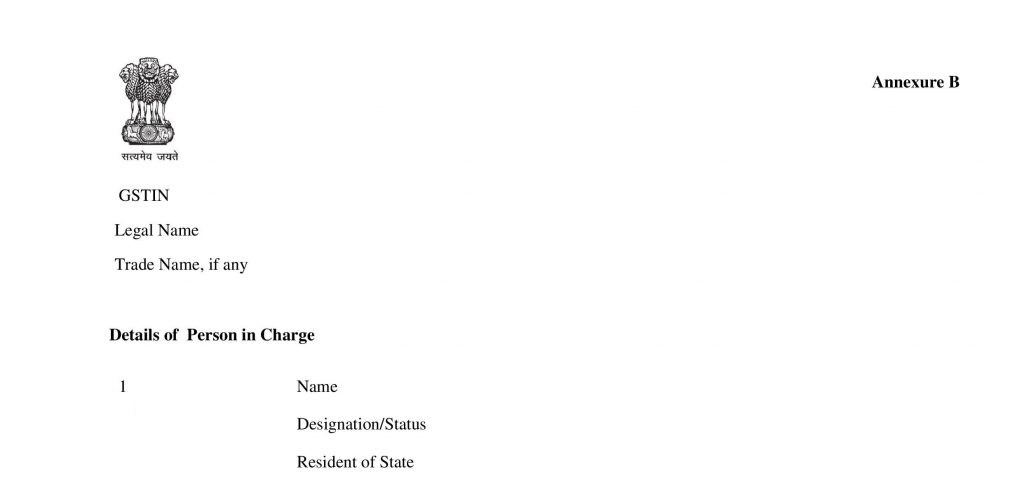

The third page ‘Annexure B’ has information of the Person in Charge of the business.

What are the updates in GST Registration Certificate?

The CBIC has notified that GST registration is not required, if annual turnover is below Rs 40 lakhs only in case of a supplier of goods except the following:

- Cases of compulsory GST registration

- Ice-cream, edible ice, pan masala, tobacco and its substitutes

- Those making sales within States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura & Uttarakhand

- Choosing Voluntary registration

The notification will be effective from 1st April 2019.