How do I check my GST Status?

GST ARN Number is nothing but the Application Reference Number, it is generated on the GST Portal automatically once you submit the GST Registration Application. You can use the GST ARN Number to track the status of your GST registration application, till the time your GST Certificate and GSTIN is not issued to you, by the Government of India.

How to generate ARN Number?

Once you submit the GST registration application on the GST portal, the ARN Number will be generated. After generating the GST ARN Number, you can use it to track the GST application Status.

How to check GST Registration Application Status?

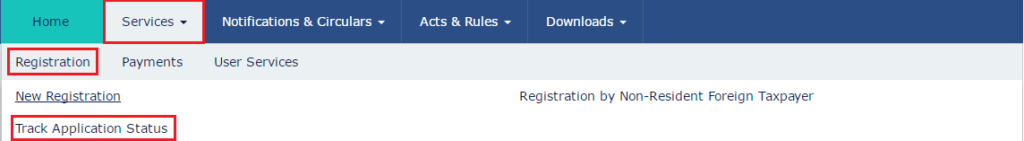

Follow the steps mentioned-below to check the GST Application Status: -

Step: 1

Visit the official GST Portal.

Step: 2

In the main menu, click on the option that says “Track Application Status under Services”.

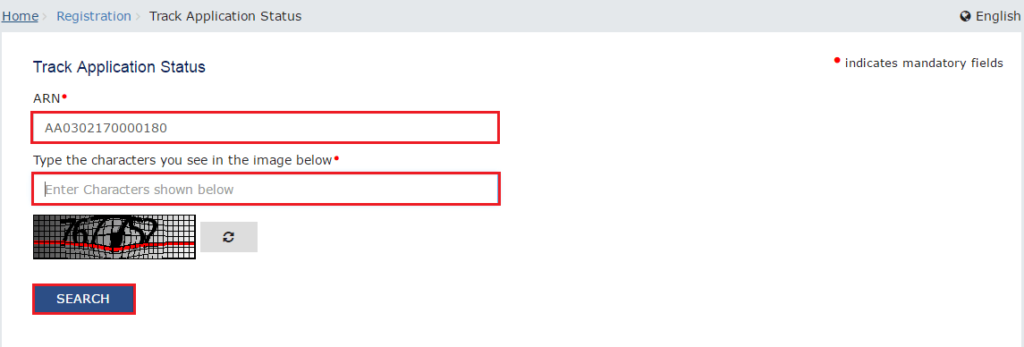

Step: 3

Next, enter the ARN in the space provided and complete the CAPTCHA

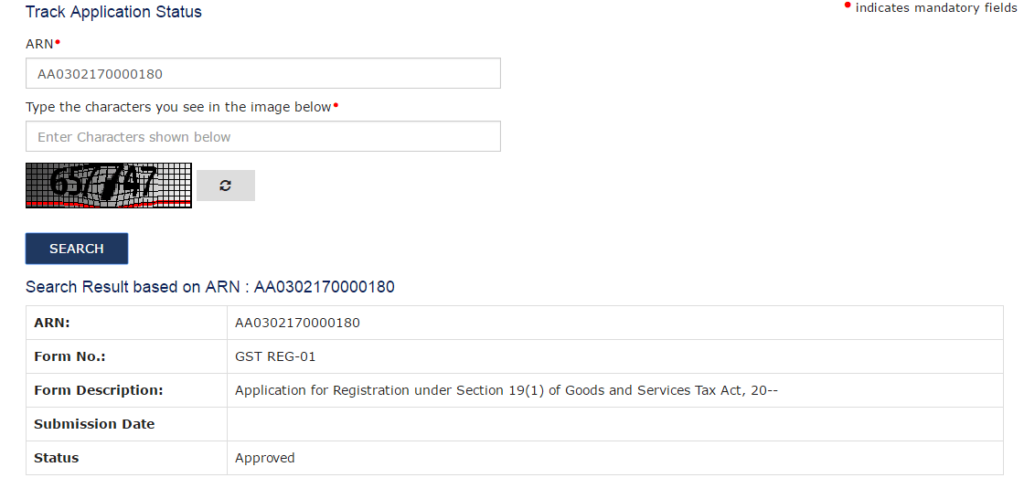

Step: 4

Once you submit the Form, your GST Application Status will be displayed on your screen.

What are the various types GST Application Status?

Once you check the GST Registration Application, you may find the following types of Status: -

Form Assigned to the Assessing Officer: This status means that, your registration application is been assigned to the assessing officer and the application is pending from the Government’s side with an officer for processing.

Pending for Clarification: This status means that, the processing officer has requested clarification on the GST registration application filed. You should submit the required clarification on the GST Portal as early as you can.

Clarification NOT Filed – Pending for Order: This means that, the clarification was not filed by the applicant within the stipulated time. An order rejecting the GST registration application will most likely be passed by the GST Officer.

Application Approved: This status means that, GST registration application has been approved by the GST Officer. You will receive the GSTIN and GST registration application shortly.

Application Rejected: GST registration application has been rejected by the GST Officer. You will have to apply again, if you need a GST registration.