Procedure of Company Name Change

The name of a company is the primary identity that makes it recognizable within the industry. Therefore, changing the name of a company is of utmost importance. Under Section 13 of the Companies Act, 2013, a company can alter name clause of MOA anytime, after its incorporation by passing a special resolution with the consent of the Members and Directors, by getting an approval from the Central Government.

There are several reasons why a company would need to change its name, one of the major reasons for this is due to a demand from the Central Government. Let’s discuss this in a little more detail –

- In case the Central Government finds that the name of a company is identical to or very closely resembles to the name of any other company that already exists, under the Companies Act, 2013 or any other company law, then the Central Government can direct the company to change its name.

- If a Proprietor of any Proprietorship, registered under the Trademarks Act, 1999, submits an application with the RoC, that the name of a Private Limited Company or One Person Company is identical to or very closely resembles the name of his Proprietorship, then the company can be asked to change its name.

- Moreover, if the ownership of a company is transferred to another individual or the management of the company changes for any reason, then they can change the name of the company as per their choice.

- A Company can also make application for name change, voluntarily.

Since change in the name of a company is a very crucial process, it is extremely important to verify the documents that need to be filed to start the process. The Members and Directors need to agree to change the name of the company and a resolution will be passed post this agreement. Buy our plan and our experts at All India ITR will take care of the process of filing the documents with the Registrar of Companies, including the E-forms, but we will need some of the documents from you, here is the list of the documents that we will require from you –

- Board Resolutions signed by signatory

- Signed copy of the notice for the General Meeting with explanatory statements

- A signed copy of the Special Resolution passed

- Copy of the minutes of the General Meeting signed by the signatory

- Copy of altered Memorandum of Association (MoA) stating the change in the name clause

- Copy of altered Articles of Association (AoA) stating the change in the name of the company

After you send us the above-mentioned documents, we will file the E-forms on your behalf along with the documents given by you. RUN form, MGT-14 and Form INC-24 are filed with the Registrar of Companies at the Ministry of Corporate Affairs. If the RoC is satisfied with the application filed, a new Certificate of Incorporation would be issued which will state the new name of the company.

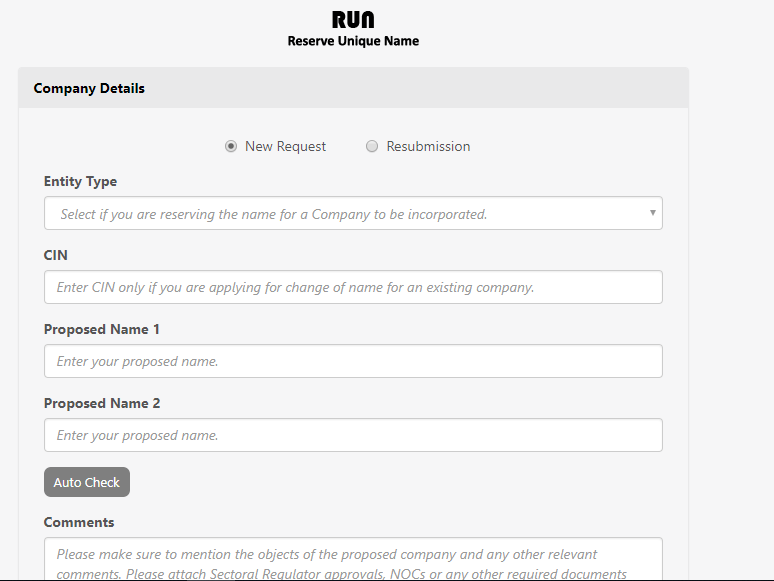

Application in RUN Form

- Reserve Unique Name (RUN) is a web service accessible on the MCA web portal which is used to reserve a name for a new company at the time of its incorporation or for changing the name of an existing company. RUN provides instant verification about the uniqueness of a proposed name, while making the reservation.

- RUN application was previously known asForm INC – 1 which was supposed to be filed with the DIN (Director Identification Number) of minimum 2 Directors and 1 DSC (Digital Signature Certificate). However, with the introduction of the RUN application, name of a company can be reserved more easily without the hassle of providing a DIN or DSC.

- The application for proposed names reserved with RUN are processed by the Central Registration Centre (CRC). The CRC reserves the name for a certain period on the basis of the information and documents provided by the applicant.

- For a new company, the CRC reserves the proposed name for a period of 20 days from the date of approval.

- In case of an existing company that is changing its name, the proposed name is reserved for a period of 60 days from the date of approval.

As stated above, there are certain rules that need to be kept in mind while reserving a suitable name for a company on the RUN web service. Some of these rules and regulations are as follows –

- The proposed name should not be identical to the name of an existing company registered under the Companies Act, 2013.

- The proposed name should not contain any word or expression that gives an impression of the company being associated with the Government, Central or State, or any other local authority unless an approval from the respective Government authority is attained.

- The proposed name should not contain any word or expression that gives an impression of the company being associated with the Government, Central or State, or any other local authority unless an approval from the respective Government authority is attained.

The application for name reservation in RUN form should be accompanied by below documents:

- Copy of Board Resolution.

- Approval of Owner of Trade Mark or the applicant of such application

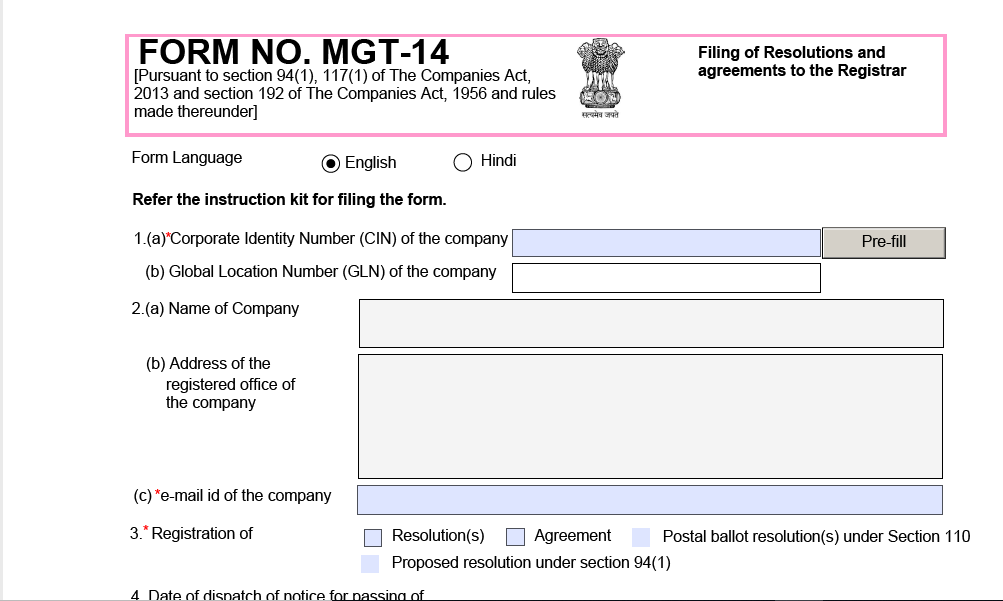

E- form MGT – 14

Form MGT -14 was introduced under the Companies Act, 2013 to file special resolutions passed by a company with the Registrar of Companies. These resolutions must be filed as soon as they are passed at the meeting held by the Shareholders of a company. The resolutions by the managing authorities of a company are broadly classified into 3 categories –

- Board Resolutions– Board Resolution is the resolution passed at the meeting of board of directors, on behalf of the company. These resolutions are filed in Annexure A of the E-form MGT – 14. Board resolutions can be related to the issue of securities, borrowing of money from any source, issuance of loans, appointment of internal or secretarial auditors, appointment or removal of significant managerial personnel, expansion of the business of the company.

-

Special Resolutions–This kind of resolution is passed with the consent of at least 75% of the members of the company in order to introduce any change in the registered office, change the name of a company, conversion of company into any other kind of company, Winding up of the company voluntarily, addition or reduction of share capital, etc.

- Ordinary Resolutions-This kind of resolution is passed when consent of more than 50% of the members of the company is required. Ordinary resolutions are mainly passed when a company issues equity shares, Remuneration payable to the directors, increase or consolidation of capital, approval of General Meetings for the purpose of issuance of bonus shares or encouraging deposit from the Members, appointment of auditors, branch auditors, Director, entering a particular contract, etc.

MGT–14 needs to be filed with the RoC within 30 days from the date of passing a resolution. It is processed, approved or taken on record through ‘Straight Through Processing’ (STP) mechanism except for change of Name, change of object, resolution for further issue of capital and conversion of companies. MCA uses STP to facilitate speedy processing of transactions wherein no manual verification is required.

E- form MGT – 24

Form MGT -24 was introduced under the Companies Act, 2013 to file special resolutions passed by a company with the Registrar of Companies. These resolutions must be filed as soon as they are passed at the meeting held by the Shareholders of a company. The resolutions by the managing authorities of a company are broadly classified into 3 categories –

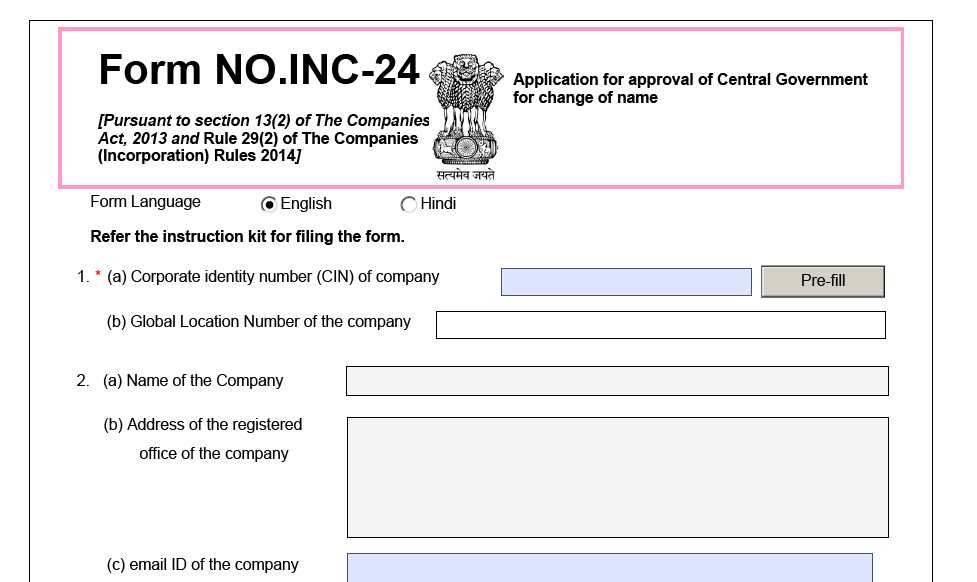

E-form INC – 24 is filed cannot be filed without attaching the following documents with it –

- Certified copy of minutes of the general meeting where the special resolution was passed for the change of the company name.

- A copy of the approval acquired from concerned authorities like RBI, IRDA, SEBI, etc. or any other concerned department. (if required)

- Notice along with Explanatory Statements.

- Altered in MOA & AOA.

Now that we’ve talked about the forms that are filed for the process of company name change, let’s discuss the procedure for the same.

- The Member of the Board summons a Board Meeting, wherein a proposal is made to change the name of the company and to initiate the application process. A notice is issued at least 7 days before board meeting with the agenda of the meeting to all Board Members.

- Conduct the board meeting and pass necessary resolutions.

- Once the Board Members consent to make this change, an application for reserving a new name for the company on the Reserve Unique Name (RUN) web service of the Ministry of Corporate Affairs web portal with a prescribed fee.

- After filing the RUN Application form, the RoC verifies the application and approves the request for reservation of the name.

- The next step is to conduct an extraordinary general meeting to take the approval of all the Members of the company on the change of the company name. This meeting is called by the Board and a notice of 21 days along with explanatory statement is given to the Members for this extraordinary general meeting.

- In this meeting, a Special Resolution for making amendments in the Memorandum of Association and Articles of Association is passed and the process of making this amendment is put to motion.

- Within 30 days of passing the Special Resolution, E-form MGT – 14 is to be filed along with the altered copy of MoA and AoA, extract of minutes of meeting, resolutions passed.

- The last step in the filing for change of company name is to file E-form INC – 24 with the Registrar of Companies along with the required documents.

- Finally, after the application for change of company name is verified by the RoC, it will be approved and you will be able to use the new name of the company for all activities regarding the business.

After the RoC gives the approval for name change, the company will need to fulfil certain formalities regarding the usage of the new name, some of them are as follows –

- Relevant Government authorities need to be intimidated about the change of the company.

- A new Permanent Account Number (PAN) is supposed to be acquired on the new name of the company.

- The bank account of the company should be updated with the new name.

- The new Memorandum of Association and Articles of Association is supposed to be printed stating the amendments that were made.

- The next step is to conduct an extraordinary general meeting to take the approval of all the Members of the company on the change of the company name. This meeting is called by the Board and a notice of 21 days along with explanatory statement is given to the Members for this extraordinary general meeting.

- The new name of the company needs to be either painted or affixed outside every office of the company or any other place where the company runs its business in a clearly visible position and in legible letters.

- The new name needs to be engraved in legible letters on the seal of the company.

- Fresh letterheads, business letters, bill heads and notices is supposed to be printed, stating the new name of the company along with address of the registered office and relevant contact details.

- Moreover, the promissory notes and bills of exchange need to have the new name of the company printed on them.

It is extremely important to make necessary amendments regarding the change of company name in every copy of the Memorandum of Association and Articles of Association. Failure to comply with these guidelines may attract certain amount penalty.

Frequently Asked Questions

To reserve name for Limited Liability Partnership RUN-LLP form is used.

PLC

PLC