Acche Din? Budget 2019

After a long wait, finally the Union Budget 2019 is here and one must remember, this budget is here to stay.

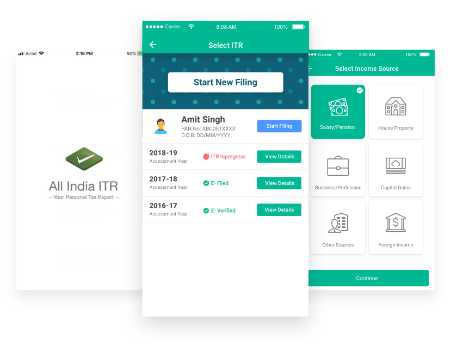

Read moreE-file Income Tax Return within 5 Minutes

After a long wait, finally the Union Budget 2019 is here and one must remember, this budget is here to stay.

Read more

Recently, the GST council doubled the exemption limit to Rs. 40 Lakhs for the payment of Goods and Services Tax.

Read more

Recently, the Income Tax Department asked the taxpayers to link their PAN Card with their Bank Account.

Read moreAn app that

For enquiries, call us on

Any Queries?

Request a Call from Us